Many credit repair companies are across the spectacle of credit repair. Locating a valid company may be challenging as there are lots of testimonials on the web. If you have been through a repair process before, you certainly know how it can heal a wounded report. Of course, in a civilized era, you can scour the internet and check the credit repair choices you have. An investigation will yield several repair companies, and locating the perfect one would be daunting. Moreover, you wouldn’t wish to spend your cash on a repair firm without a significant track record. Having helped many people solve their credit difficulties, Lexington Law is an incredibly reputable firm. Arguably, remaining in business for long doesn’t guarantee results, however Lexington Law provides a lot. At a highly-monitored surroundings, this company has continually maintained strict federal standards. Lexington Law has also helped consumers achieve excellent outcomes for close to two years. Lexington Law has a remarkably excellent track record and is certainly worth your consideration.

The FCRA gives the provision to remove any harmful element in your credit report. Mostly, if the credit bureau can’t confirm the info, it must delete it. The three information centers — Experian, Equifax, and TransUnion — are more prone to making mistakes . According to the FCRA, at least 20% of US citizens have mistaken in their credit reports. Your credit report depends in your score, and a bad score could critically plummet your credit rating. Your score dictates your own creditworthiness in almost any credit card program of traditional loans. Many loan applicants have experienced an ineffective program because of a low credit score. Ever since your loan negotiation capacity would be crippled due to negative entries, you should delete them. Several negative entries in your credit report can cripple your ability to acquire good quality loans. Since damaging items can affect you severely, you need to work on removing them from the report. You’re able to remove the negative items on your own or involve a credit repair firm. Many men and women use credit repair businesses when they have to go through plenty of legal technicalities. Because credit repair can be a daunting process, we have compiled everything you want to learn here.

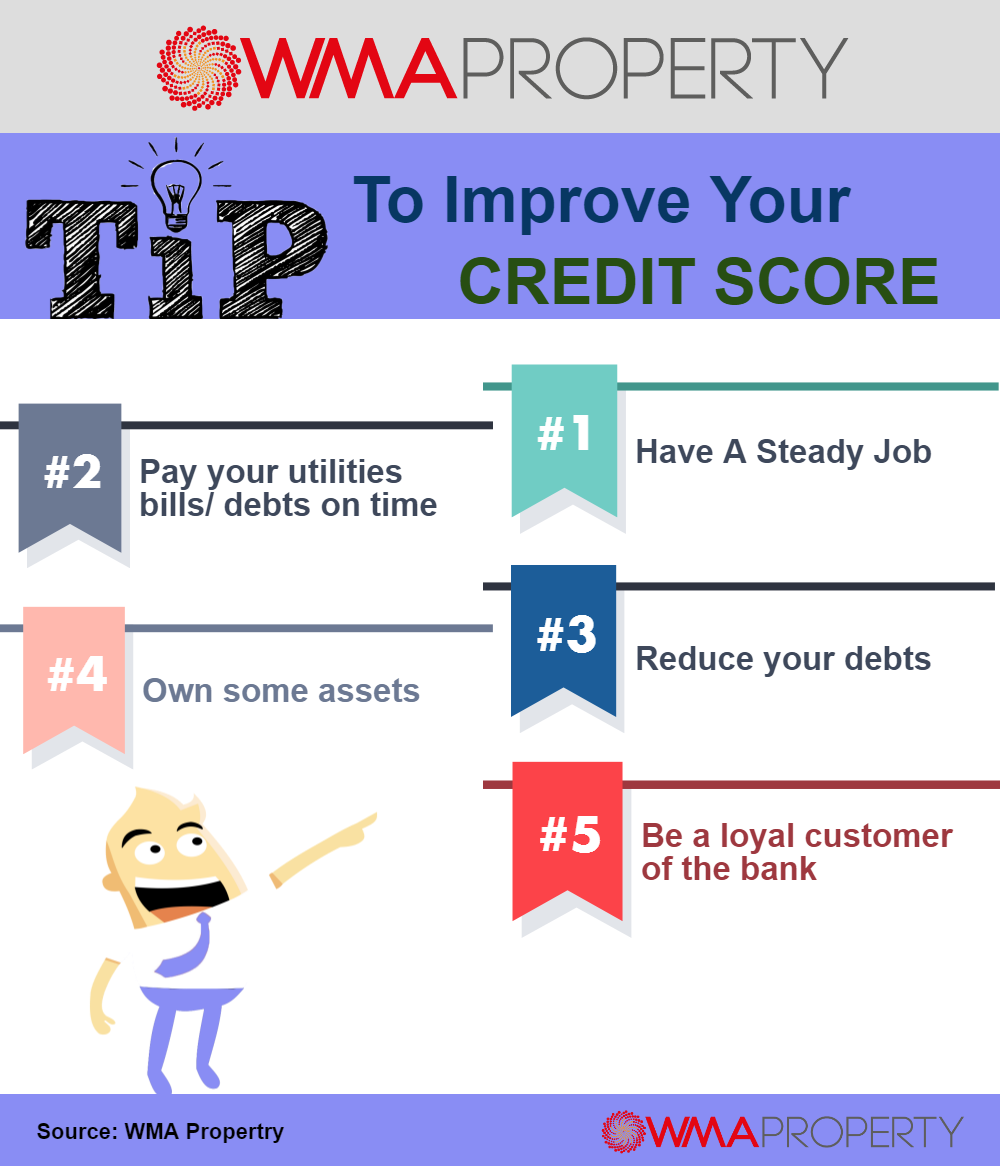

Rather than checking your whole report, prospective lenders use your credit score to judge you. The credit score calculation and evaluation models vary between various loan issuers. Additionally, credit card firms also use tailored strategies when checking a credit report. Loan issuers would give someone with a high score an upper hand in contrast to one with a low score. If your program gets successful, you’ll pay expensive interest rates and charges. It’s imperative to see your finances to prevent damaging your credit score and report. Assessing your credit score often would give you a very clear overview of your financial well-being. Considering that the three data centers give consumers a free credit report per year, Credit Card Tips you should maximize it. Once you retrieve your credit file, you need to examine the items that hurt your credit score. Focus on removing the things that you can before going for the ones that need legal procedures. Should you need a credit repair firm, select one which matches your unique requirements. Ideally, assessing your own credit report regularly would help you manage your finances well.

Credit Saint can be a perfect choice if you choose to call for a credit repair company. It is among those few associations using an A+ BBB rating; therefore it has plenty to offer. As a respectable company that has worked for close to 15 years, Credit Saint is one of the highest-ranked. One important element is how Credit Saint educates consumers about different credit issues. Additionally, it has three payment options from which you’ll choose based on your needs. When preparing dispute letters, the paralegals customize the claims based on your precise requirements. It’s great knowing they have a 90-day money-back guarantee if you are not completely satisfied. But like any other service provider, Credit Saint has its related downsides. From top installation fees to limited availability, credit saint includes a few associated downsides. If you’re residing in South Carolina, then you may need to seek the assistance of other service providers.

Based on the FCRA’s provisions, it is possible to recover and dispute any negative information in your document. If you loved this informative article and you wish to receive much more information relating to https://Play.google.com/store/apps/details?id=com.creditoptimal.app157328 assure visit our own web site. In nature, the responsible information center has to delete the information if it can not confirm it as legitimate. Like any other entity, credit data centers tend toward making lots of errors, particularly in a credit report. In accordance with the FCRA, at least 20% of US taxpayers have confused in their credit reports. Since your score is dependent on your own report, a bad report may damage your score seriously. Your score dictates your creditworthiness in almost any credit card application of traditional loans. Many loan applicants have had an unsuccessful application because of a bad credit score. Since your loan negotiation capacity will be crippled because of adverse entries, you should delete them. From delinquencies to bankruptcies, compensated collections, and queries, such components can impact you. Since damaging things can affect you severely, you should work on removing them from the report. There are different means of removing negative items, and one of these is a credit repair company. Many people use credit repair companies when they must go through lots of legal technicalities. In this article, we’ve collated everything you need to learn about credit repair.