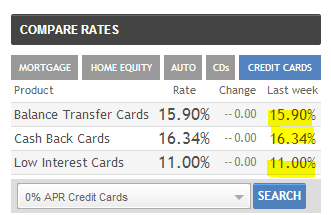

Across the united states, with a credit card continues being one of the most efficient fiscal instruments. Countless consumer accounts point to their unbowed efforts to acquiring a credit card. Like every other product, a credit card has a wide assortment of advantages and associated cons. Through application, credit card issuers look at several metrics before approving your own card application. This variable means that your chances of acceptance when you have a poor score, are amazingly slim. Besides, you’ll need to watch a couple of items once you get your card. If you go beyond the 30 percent credit utilization limit, your credit rating would undoubtedly drop. Through the program, the issuer would carry out a hard inquiry that would fall your credit score. The more you have unsuccessful applications, the more inquiries you’ll have on your report. As soon as you get the card, adhering to the strict credit regulations would work to your leverage. Failure to obey the regulations would tank your credit score and harm your report.

Without a doubt, many items can influence your credit report and tank your own score. If you have any questions with regards to in which and how to use https://soussmiel.Com, you can make contact with us at our own website. Essentially, credit repair is the process of fixing your credit by deleting the harmful entries. In some instances, deleting the negative entries may be as straightforward as disputing the items with the agencies. But some events, like fraudulent actions, can be an uphill task for you. As a walkabout with this daunting process, you’ll have to engage a repair business to prevent complexities. Additionally, fraud and identity theft usually entail a series of well-choreographed criminal activities. If you don’t hire a credit repair company, unraveling these connections may prove useless. Though many people solved this matter independently, involving a provider is normally the best approach. For this reason, you’ll sometimes have to engage a credit repair company to repair the elements. Whichever the case, you might complete the repair procedure on your own or call for a repair company.

Obtaining a conventional loan or line of credit may be daunting in the event that you’ve got poor credit. Although a loan is exactly what you need to construct your own credit, such a circumstance is certainly counterintuitive. But the excellent news is you can find a secured credit card with bad credit. Some creditors could be more willing to issue credit cards to consumers even if they have zero history. Mostly, you’ll need to secure a deposit which will be deducted if you fail to clear the balance. Card issuers accumulate basic identification information and financial data from the card candidates. After awarding the issuer permission for Credit Tips a soft query, you’re initiate the transaction for the deposit. In some situations, you’ll supply account information for the issuer to debit the amount directly. Obviously, secured credit cards possess a huge difference from the traditional cards. Secured credit cards possess some comparative downsides to an unsecured card.

Obtaining a conventional loan or line of credit may be daunting in the event that you’ve got poor credit. Although a loan is exactly what you need to construct your own credit, such a circumstance is certainly counterintuitive. But the excellent news is you can find a secured credit card with bad credit. Some creditors could be more willing to issue credit cards to consumers even if they have zero history. Mostly, you’ll need to secure a deposit which will be deducted if you fail to clear the balance. Card issuers accumulate basic identification information and financial data from the card candidates. After awarding the issuer permission for Credit Tips a soft query, you’re initiate the transaction for the deposit. In some situations, you’ll supply account information for the issuer to debit the amount directly. Obviously, secured credit cards possess a huge difference from the traditional cards. Secured credit cards possess some comparative downsides to an unsecured card.

Based on the FCRA’s provisions, you can retrieve and dispute any negative information in your report. The credit reporting agency is bound to delete a disputed thing that’s shown to be illegitimate. Credit information facilities make lots of mistakes — making such errors highly prevalent. A close examination of American consumers reveals that about 20 percent of these have errors in their reports. Your credit report is directly proportional to your own score, meaning that a bad report may hurt you. For any typical loan or credit, your credit score tells the type of consumer you’re. Many loan applicants have experienced an unsuccessful program because of a bad credit score. It’s essential to focus on removing the negative entries from your report keeping this factor in mind. Late payments, bankruptcies, hard inquiries, paid collections, and deceptive activity can impact you. Since negative components on a credit report may affect you, you need to try and remove them. Besides removing the entries by yourself, one of the most effective ways is using a repair firm. Several consumers choose to utilize a repair business when they realize they can’t go through all hoops. In this piece, we’ve compiled a thorough set of steps on which you want to learn about credit restoration.

Dependent on the FCRA’s provisions, you can recover and dispute any negative information on your document. In essence, the responsible data center needs to delete the data if it can’t verify it as legitimate. Like any other entity, credit data centers tend toward making a great deal of mistakes, particularly in a credit report. A close examination of American customers reveals that about 20 percent of them have errors in their own reports. Your credit report is directly proportional to your own score, meaning that a bad report may hurt you. Because your score informs the type of customer you are, you need to put heavy emphasis on it. Oftentimes, a bad score may impair your ability to get positive rates of interest and quality loans. It’s essential to focus on removing the negative entries from the report keeping this factor in mind. There are plenty of negative things that, if you don’t give adequate attention, could hurt your report. Since damaging things can impact you badly, you should work on removing them from your report. There are distinct means of removing negative items, and one of these is a credit repair firm. Several consumers choose to utilize a repair company when they realize they can not go through all hoops. To make certain you go through all the steps with ease, we’ve compiled everything you need to know here.

Rather than a conventional page-by-page evaluation, lenders often use your credit score to judge you. Different loan issuers utilize customer-specific versions to check their customers’ credit reports. The same differences in credit calculation versions also apply to credit card companies. Once you’ve got bad credit, lenders will less likely consider your loan software. If your application becomes successful, you’ll incur costly rates of interest and fees. Thus, tracking your financing would help you stay on top of those. Assessing your credit score is an effective means of monitoring your finances. The three information centers provide a free credit report to consumers each year. Grab a copy of your report and inspect the components hurting your credit score — like fraud or errors. Start by simply removing the easy items before participating in the ones that require legal attention. Since many credit repair businesses offer you closely-similar services, select the one that suits you. Checking your report regularly and maintaining sound fiscal habits would function to your leverage.

Rather than a conventional page-by-page evaluation, lenders often use your credit score to judge you. Different loan issuers utilize customer-specific versions to check their customers’ credit reports. The same differences in credit calculation versions also apply to credit card companies. Once you’ve got bad credit, lenders will less likely consider your loan software. If your application becomes successful, you’ll incur costly rates of interest and fees. Thus, tracking your financing would help you stay on top of those. Assessing your credit score is an effective means of monitoring your finances. The three information centers provide a free credit report to consumers each year. Grab a copy of your report and inspect the components hurting your credit score — like fraud or errors. Start by simply removing the easy items before participating in the ones that require legal attention. Since many credit repair businesses offer you closely-similar services, select the one that suits you. Checking your report regularly and maintaining sound fiscal habits would function to your leverage. Based on the FCRA’s provisions, it is possible to recover and dispute any negative information on your document. In nature, the responsible data center has to delete the information if it can’t verify it as legitimate. The three data centres — Experian, Equifax, and TransUnion — are prone to making mistakes in reports. A detailed examination of American consumers reveals that roughly 20 percent of them have errors in their reports. Your credit report is directly proportional to a own score, meaning that a bad report could hurt you. Your score dictates your creditworthiness in any credit card program of conventional loans. Many loan applicants have experienced an ineffective program due to a bad credit score. Having said that, it’s vital to focus on eliminating negative entries from your credit report. There are plenty of negative things which, if you don’t give sufficient attention, could damage your report. Since negative elements on a credit report may affect you, you need to make an effort and eliminate them. Apart from removing the entries on your own, one of the most effective ways is using a repair company. Several consumers opt to utilize a repair company when they recognize they can’t undergo all hoops. To ensure you go through all the steps easily, we’ve compiled everything you need to learn here.

Based on the FCRA’s provisions, it is possible to recover and dispute any negative information on your document. In nature, the responsible data center has to delete the information if it can’t verify it as legitimate. The three data centres — Experian, Equifax, and TransUnion — are prone to making mistakes in reports. A detailed examination of American consumers reveals that roughly 20 percent of them have errors in their reports. Your credit report is directly proportional to a own score, meaning that a bad report could hurt you. Your score dictates your creditworthiness in any credit card program of conventional loans. Many loan applicants have experienced an ineffective program due to a bad credit score. Having said that, it’s vital to focus on eliminating negative entries from your credit report. There are plenty of negative things which, if you don’t give sufficient attention, could damage your report. Since negative elements on a credit report may affect you, you need to make an effort and eliminate them. Apart from removing the entries on your own, one of the most effective ways is using a repair company. Several consumers opt to utilize a repair company when they recognize they can’t undergo all hoops. To ensure you go through all the steps easily, we’ve compiled everything you need to learn here.

Rather than assessing your whole report, prospective lenders use your credit score to judge you. The credit rating calculation and evaluation models differ between various loan issuers. Similarly, credit card businesses use various strategies to check their consumer credit reports. Loan issuers would give somebody with a high score an upper hand compared to one using a low score. If your application becomes powerful, you’ll incur costly interest rates and charges. Therefore, you should watch your finances that will help you avoid any issues. You’ll be able to track your score to give you a detailed summary of your credit score. You can retrieve a free credit report from each of the data centers for free. Grab a copy of your report and inspect the elements hurting your credit rating — like fraud or errors. Start by simply removing the easy items before participating in those that need legal care. Should you require a credit repair firm, pick one which matches your unique needs. Having good fiscal habits and assessing your report often would help keep you on top of your financing.

Rather than assessing your whole report, prospective lenders use your credit score to judge you. The credit rating calculation and evaluation models differ between various loan issuers. Similarly, credit card businesses use various strategies to check their consumer credit reports. Loan issuers would give somebody with a high score an upper hand compared to one using a low score. If your application becomes powerful, you’ll incur costly interest rates and charges. Therefore, you should watch your finances that will help you avoid any issues. You’ll be able to track your score to give you a detailed summary of your credit score. You can retrieve a free credit report from each of the data centers for free. Grab a copy of your report and inspect the elements hurting your credit rating — like fraud or errors. Start by simply removing the easy items before participating in those that need legal care. Should you require a credit repair firm, pick one which matches your unique needs. Having good fiscal habits and assessing your report often would help keep you on top of your financing.