Paying past the due date could drop your score by an important number of factors. The reason behind this fact is that on-time payments contribute considerably to your credit report. Your credit rating could always plummet if you already possess a significantly low score. In some instances, it’s sensible to default due to a financial crisis or unprecedented situations. If you have any kind of concerns regarding where and the best ways to make use of click through the up coming post, you can contact us at the web-page. Some loan issuers could provide you time to recuperate if you had some explainable financial hitch. But always making late payments could be detrimental to your financial wellbeing. The loan issuers can report an overdue payment to the bureaus should you make it late than 30 days. Exceeding this window will influence your ability to borrow loans or bargain favorable interest prices. This is because potential lenders will consider you a speculative debtor and reject your program. In conclusion, making timely payments would definitely work to your leverage.

Paying past the due date could drop your score by an important number of factors. The reason behind this fact is that on-time payments contribute considerably to your credit report. Your credit rating could always plummet if you already possess a significantly low score. In some instances, it’s sensible to default due to a financial crisis or unprecedented situations. If you have any kind of concerns regarding where and the best ways to make use of click through the up coming post, you can contact us at the web-page. Some loan issuers could provide you time to recuperate if you had some explainable financial hitch. But always making late payments could be detrimental to your financial wellbeing. The loan issuers can report an overdue payment to the bureaus should you make it late than 30 days. Exceeding this window will influence your ability to borrow loans or bargain favorable interest prices. This is because potential lenders will consider you a speculative debtor and reject your program. In conclusion, making timely payments would definitely work to your leverage.

Launched in 1989, sky blue is a credit repair company that is based in Florida Credit saint argues that most customers start seeing positive results after 30 days of usage. Besides, the company highlights that consumers use their solutions for six weeks to become fully happy. When utilizing sky blue credit, you will undoubtedly gain from a mammoth of its associated advantages. In the course of your subscription, you can pause the subscription by contacting customer service. In case you don’t reach your desired outcome, you can be given a complete refund within 90 days of your claim. Without a doubt, sky blue has some drawbacks, particularly on the setup and credit report fees. One unusual element about sky blue credit is that you’ll have to pay a retrieval fee of $39.95. Moreover, you are going to be asked to pay a set up charge of $69 with no guarantee for reliable outcomes. You can renew your subscription for weeks without seeing a considerable amount of progress. Since fixing credit requires some significant investment, you must make your choices carefully.

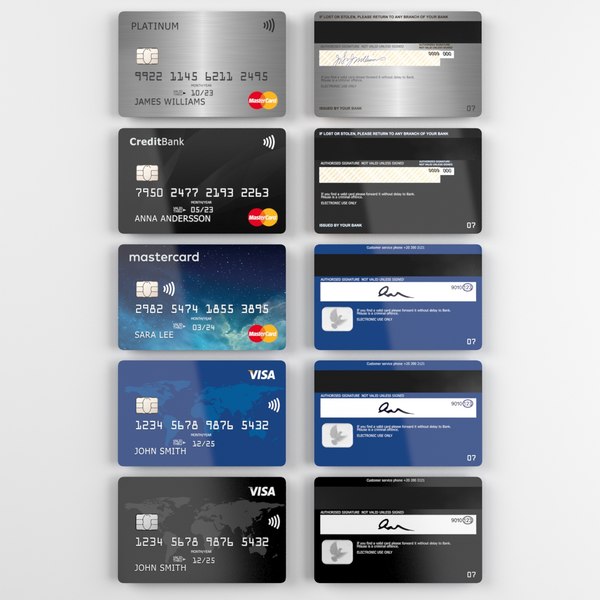

Potential lenders do not check your whole credit report; they utilize your score to judge you. Various lending businesses use customized approaches to look at their consumers’ reports. Additionally, credit card companies also use tailored strategies when assessing a credit report. Your application will less likely succeed when you’ve got a poor credit score and report. If your program gets successful, you’re incur costly rates of interest and fees. It’s imperative to see your finances to avoid damaging your credit score and report. Assessing your credit score often would give you a very clear overview of your fiscal well-being. Considering that the three data centers give customers a free credit report each year, you should maximize it. After regaining your account, you should check the items that seriously damage your own credit report. You should begin working on the simple things before involving paralegals in taking away the complex ones. If you may require a credit repair firm, be sure to select the one which suits your needs and budget. Ideally, assessing your credit report regularly would help you handle your finances well.

Defaulting can hurt your credit report and drop your credit score significantly. Making timely payments account for a huge chunk of your accounts, thus defaulting can affect you. Your credit rating could continually plummet if you presently have a significantly low score. If some unprecedented situation comes your way, making late payments can be clear. If your problem is explainable, some loan issuers could provide you room to make the payment. In the event that you always make late payments, potential creditors could see you in another perspective. The federal law states that overdue payments could only be reported if they are 30 times late. Going beyond this window could influence your ability to get additional loans from potential lenders. Continuous delinquencies would make lenders perceive you as a high-risk borrower. In conclusion, making timely payments will undoubtedly work to your leverage.

If you decide to hire a credit repair firm, Credit Saint might be the perfect choice. Among the few credit associations using an A+ BBB score, Credit Saint has a lot to offer. Charge Saint has been operating for more than ten years and among the highly-ranked repair businesses. One of the greatest advantages of Credit Saint is the way that it educates consumers about different credit issues. To accommodate different consumer requirements, Credit Saint includes three payment options. When preparing dispute letters, the paralegals personalize the claims based on your specific requirements. It’s great knowing that they have a 90-day money-back guarantee if you are not completely satisfied. Unsurprisingly, credit saint has some related drawbacks. From high setup fees to restricted accessibility, credit saint has a few related downsides. If you’re residing in South Carolina, then you might need to look for the assistance of other service providers.

If you’ve had a bad credit history, you might find another opportunity to have a checking account. If your program for a standard checking account isn’t fruitful, second chance checking will be perfect. Before approving your application, the financial institution describes the ChexSystems database. Banks report bad credit behavior coupled with your financial documents to the ChexSystems database. If your documents are in this database, then it means your credit history is not comprehensive. If your name appears on this database, your chances of having a checking account would be slim. In their efforts to help consumers repair bad reports, several financial institutions offer these reports. That stated, there’s a difference between a typical checking account and the second chance kind. Naturally, the second opportunity account has corresponding perks and cons. While they offer a chance to rebuild your broken credit, they generally have expensive fees. Worse still, you can not overdraw funds from your second chance checking accounts. Despite these drawbacks, instant chance accounts are far better compared to secured credit cards or even check-cashing.

If you’ve had a bad credit history, you might find another opportunity to have a checking account. If your program for a standard checking account isn’t fruitful, second chance checking will be perfect. Before approving your application, the financial institution describes the ChexSystems database. Banks report bad credit behavior coupled with your financial documents to the ChexSystems database. If your documents are in this database, then it means your credit history is not comprehensive. If your name appears on this database, your chances of having a checking account would be slim. In their efforts to help consumers repair bad reports, several financial institutions offer these reports. That stated, there’s a difference between a typical checking account and the second chance kind. Naturally, the second opportunity account has corresponding perks and cons. While they offer a chance to rebuild your broken credit, they generally have expensive fees. Worse still, you can not overdraw funds from your second chance checking accounts. Despite these drawbacks, instant chance accounts are far better compared to secured credit cards or even check-cashing. If you decide to engage a credit repair firm, Credit Saint might be the ideal option. Since it’s got an A+ rating according to BBB, Credit Saint has plenty of convenient items to offer. Charge Saint has been operating for more than a decade and one of the highly-ranked repair businesses. One of the greatest perks of Credit Saint is the way that it educates consumers about various credit issues. Besides, Credit Saint accommodates different customer needs using its three payment bundles. When preparing dispute letters, the paralegals customize the claims according to your precise requirements. The company has a 90-day money-back guarantee that will assist you receive a refund if you’re not satisfied. Besides all of the perks of the company, credit saint has some disadvantages. The company has high setup fees ranging from $99 to $195 and has limited availability. If you’re living in South Carolina, you might have to consider other repair businesses.

If you decide to engage a credit repair firm, Credit Saint might be the ideal option. Since it’s got an A+ rating according to BBB, Credit Saint has plenty of convenient items to offer. Charge Saint has been operating for more than a decade and one of the highly-ranked repair businesses. One of the greatest perks of Credit Saint is the way that it educates consumers about various credit issues. Besides, Credit Saint accommodates different customer needs using its three payment bundles. When preparing dispute letters, the paralegals customize the claims according to your precise requirements. The company has a 90-day money-back guarantee that will assist you receive a refund if you’re not satisfied. Besides all of the perks of the company, credit saint has some disadvantages. The company has high setup fees ranging from $99 to $195 and has limited availability. If you’re living in South Carolina, you might have to consider other repair businesses.

If your application was unsuccessful, you might open another chance checking account. Second chance accounts are intended for applicants who have been denied a typical checking accounts. Before approving the application, the financial institution describes the ChexSystems database. Banks report bad credit behavior coupled with your financial records to the ChexSystems database. In case your data looks in ChexSystems, it means you don’t have a good repayment history. This implies that if you have a faulty history, your own success rate will certainly be slender. In their attempts to help consumers repair bad reports, several financial institutions offer these reports. But you won’t find solutions which are in a normal checking account in a second chance account. Without a doubt, second chance checking accounts have advantages and disadvantages. While they offer a opportunity to rebuild your broken credit, they generally have pricey fees. Worse still, you can’t overdraw funds from the second chance checking accounts. Despite these drawbacks, instant chance accounts are far better than secured credit cards or even check-cashing.

If your application was unsuccessful, you might open another chance checking account. Second chance accounts are intended for applicants who have been denied a typical checking accounts. Before approving the application, the financial institution describes the ChexSystems database. Banks report bad credit behavior coupled with your financial records to the ChexSystems database. In case your data looks in ChexSystems, it means you don’t have a good repayment history. This implies that if you have a faulty history, your own success rate will certainly be slender. In their attempts to help consumers repair bad reports, several financial institutions offer these reports. But you won’t find solutions which are in a normal checking account in a second chance account. Without a doubt, second chance checking accounts have advantages and disadvantages. While they offer a opportunity to rebuild your broken credit, they generally have pricey fees. Worse still, you can’t overdraw funds from the second chance checking accounts. Despite these drawbacks, instant chance accounts are far better than secured credit cards or even check-cashing.