Credit Saint can be a perfect choice if you opt to involve a credit repair firm. It is among the few institutions using an A+ BBB rating; therefore it has plenty to give. Credit Saint has assisted consumers resolve credit problems for over a decade hence has a fantastic history. One notable element is how the provider continuously educates is customers on various credit problems. Moreover, Credit Saint accommodates different consumer needs using its own three payment packages. When preparing the dispute letters, then the legal staff would utilize tailored letters to fit your specific requirements. One noteworthy perk of the company is your 90-day money-back guarantee in case you’re not fully satisfied. Besides all the perks of the company, credit saint has some disadvantages. Charge saint has significantly large installation fees and has limited accessibility. Having said that, you might have to utilize other service providers if you live in South Carolina.

Everyone makes bill payments — from loans to credit cards and lines of credit. In case you don’t meet your financial obligations in time, creditors will make attempts to collect their cash. Each time a collection agency makes efforts to recover the cash, it adds to your report for a collection. In the most recent FICO versions, paid collections will not damage your score, but unpaid ones certainly will. When one of your accounts goes into collection, your score drops depending on some distinctive facets. When you have a high score, you are going to lose more things than somebody with few points, and the converse is true. If you skip a payment, your creditor would report it to the bureaus as”payment” But if you don’t pay penalties or bring your accounts to status, you might encounter a collection. When your account goes into collection, you will immediately see your credit score dropping. Since it takes a very long time to work out a collection, making timely payments would be your ideal strategy.

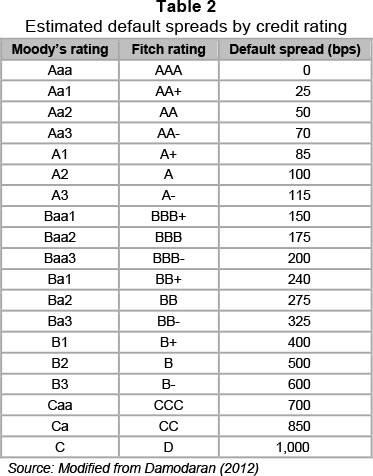

Instead of assessing your entire report, potential lenders use your credit score to judge you. The credit score calculation and scrutiny models vary between different loan issuers. Besides, they use this model because different credit card companies have different credit rating models. If you’ve got poor credit, loan issuers are far less likely approve your program. If your program gets powerful, you’re pay expensive interest rates and fees. For this reason, keeping your eye on your financing will help keep you on top of your financing. You can monitor your score to offer you a comprehensive summary of your credit score. If you cherished this article and you would like to acquire more information concerning Credit Rates kindly go to our webpage. Since the 3 bureaus give free reports to consumers every year, you should use it to your leverage. Catch a copy of your report and inspect the components hurting your credit score — like fraud or errors. You should start working on the simple things before involving paralegals in removing the complex ones. If you require a credit repair firm, select one that matches your unique requirements. Always remember to keep good financial habits and assess your report regularly.

Instead of assessing your entire report, potential lenders use your credit score to judge you. The credit score calculation and scrutiny models vary between different loan issuers. Besides, they use this model because different credit card companies have different credit rating models. If you’ve got poor credit, loan issuers are far less likely approve your program. If your program gets powerful, you’re pay expensive interest rates and fees. For this reason, keeping your eye on your financing will help keep you on top of your financing. You can monitor your score to offer you a comprehensive summary of your credit score. If you cherished this article and you would like to acquire more information concerning Credit Rates kindly go to our webpage. Since the 3 bureaus give free reports to consumers every year, you should use it to your leverage. Catch a copy of your report and inspect the components hurting your credit score — like fraud or errors. You should start working on the simple things before involving paralegals in removing the complex ones. If you require a credit repair firm, select one that matches your unique requirements. Always remember to keep good financial habits and assess your report regularly.

There are plenty of items which can affect your credit report and tank your own score. Basically, credit repair is the process of fixing your credit by deleting the detrimental entries. In certain situations, it entails disputing the items together with the various data centres. Nevertheless, some cases such as identity theft and fraud may present unprecedented challenges for you. As a walkabout with this daunting process, you are going to need to engage a repair company to prevent complexities. Besides, fraud and identity theft usually involve a chain of well-connected criminal pursuits. Unsurprisingly, unraveling the series of these chains may prove futile if you do it on your own. Though some people solved this matter independently, involving a provider is usually the best approach. Due to these complexities, you may need to hire a repair business to help you out. Still, you can successfully lodge a dispute and complete the process on your own or use a repair service.

The FCRA explicitly claims you could dispute any negative item on a credit report. Primarily, if the credit bureau can not confirm the information, it must delete it. Charge information facilities make lots of mistakes — making such errors highly prevalent. The FCRA asserts that close to one in every five Americans have mistakes in their reports. Your credit report is directly proportional to a score, which means that a lousy report could hurt you. For any standard loan or line of credit, your credit score tells the type of consumer you are. Most loan issuers turn down applications since the consumers have a poor credit rates or no credit score report. It is essential to work on removing the negative entries from your report maintaining this factor in mind. From delinquencies to bankruptcies, compensated collections, and inquiries, such elements can impact you. Since harmful elements can harm your report seriously, you should work on their deletion. There are different ways of removing negative items, and one of these is a credit repair firm. Several consumers opt to utilize a repair company when they recognize they can’t undergo all hoops. In this article, we have collated everything you need to know about credit repair.