The FCRA gives the provision to eliminate any harmful element in your credit report. Basically, if the reporting agency can not confirm the item, it certainly has to be eliminated. Since no entity is foolproof of creating mistakes, credit data centers have some errors in customer reports. A close evaluation of American consumers shows that roughly 20% of these have errors in their own reports. Your credit report is directly proportional to your score, which means that a bad report may hurt you. For any typical loan or credit, your credit score tells the kind of customer you are. In many situations, a bad credit score could affect your ability to acquire good quality loans. It is vital to work on removing the negative entries from your report maintaining this factor in mind. Several negative entries on your credit report may cripple your ability to get decent quality loans. Since negative elements on a credit report can affect you, you need to try to eliminate them. You can remove the negative items on your own or involve a credit repair firm. Several consumers opt to use a repair company when they recognize they can’t undergo all hoops. Since credit repair can be an overwhelming process, we have compiled everything you need to know here.

There is a mammoth of credit repair businesses in the landscape of credit. Finding a legitimate business could be hard as there are lots of reviews on the internet. Almost everybody who’s gone through this process knows how it can help restore a broken report. Naturally, in a budding age, it is possible to authenticate the internet and check the credit repair options you have. At a glance, you will observe that picking from the countless repair companies on the internet can be difficult. Also, everyone is fearful of investing in a business which doesn’t have any strong yields. Having helped several consumers since 2004, Lexington Law has a significant history. While being in business doesn’t mean a company is good enough, Lexington has over this to offer. At a highly-monitored environment, this firm has always maintained strict national standards. Lexington Law has also helped customers achieve excellent results for close to two years. Among those high-rated credit repair companies, Lexington Law is definitely worth your consideration.

Making late payments can tank your credit score by about 100 points. Since on-time payments are among those critical boosters of your credit score, defaulting can sting you. Your credit score could continually plummet in the event that you presently have a considerably low score. Sometimes it is reasonable to pay late because of a job loss on an unprecedented financial crisis. If you experienced some issue, your loan issuer could understand and give you a bit of grace period. In the event that you always make overdue payments, potential creditors could see you at a different perspective. According to Federal law, a late payment is only going to be reported to the agencies is it is 30 days . But surpassing this 30-day window will cripple your ability to get decent quality loans. That said, exceeding this window would make lenders perceive you as a high-risk borrower. On a finishing note, making timely payments will function to your leverage.

Having bad credit isn’t the end of the street — you may make an application for a second chance checking accounts. If your application for a standard checking account is not prosperous, second chance checking will be ideal. Throughout acceptance, the lender would consult with the ChexSystems database. ChexSystems is a data centre to which many financial institutions report poor credit behavior. Hunting on ChexSystems means that you don’t have a formerly excellent credit history. Appearing on the ChexSystems database ensures that your chances of success are astoundingly low. Some financial institutions provide their customers a second chance to build a fantastic credit report. That stated, there’s some difference between a standard checking account along with the second opportunity type. Like every other product, second chance checking account have advantages and disadvantages. Even though you can use second chance checking accounts to reconstruct credit, they generally have high fees. Worse still, you can’t overdraw funds from the second chance checking account. Despite these drawbacks, second chance accounts are better compared to secured credit cards or check-cashing.

In most US states, several people work so tough to make purchases using a credit card. Countless consumer stories point towards going through huge hurdles to acquiring one. Of course, a credit card has its own associated advantages plus a few disadvantages too. Before issuing you a card, charge card companies consider several metrics before approving it. Quite simply, having a very low credit score would almost guarantee a flopped program. If you have any thoughts pertaining to where by and how to use Credit Rates, you can call us at our own web-page. You will have to take into account your spending habits, usage, and payments after getting the card. If you exceed the 30% use threshold or default in your payments, your credit score will drop. In addition, the program adds a hard inquiry to your account, which also affects your score. The more your application flops, the more questions are added to your report. As soon as you receive the card, then adhering to the strict credit regulations will function to your leverage. In case you don’t stick to the strict regulations, you’ll definitely get affected by the consequences.

Across the united states, with a credit card continues being one of the most efficient fiscal instruments. Several people narrate how hard it’s to get a credit card without issues successfully. Like every other solution, a credit card has a whole range of advantages and related cons. Before issuing you a card, charge card businesses consider several metrics prior to approving it. Quite simply, obtaining a low credit score would almost guarantee a flopped application. After obtaining the card, you’ll have to look at your spending habits, payment history, and use. If you neglect to keep good financial habits, your credit score would certainly drop. Besides, sending your program authorizes the issuer to execute a hard inquiry which affects your score. The more your application flops, the more inquiries are added to a report. In regards to having a credit card, many issuing firms have incredibly stringent regulations. If you don’t stick to the strict regulations, you will undoubtedly get influenced by the results.

Across the united states, with a credit card continues being one of the most efficient fiscal instruments. Several people narrate how hard it’s to get a credit card without issues successfully. Like every other solution, a credit card has a whole range of advantages and related cons. Before issuing you a card, charge card businesses consider several metrics prior to approving it. Quite simply, obtaining a low credit score would almost guarantee a flopped application. After obtaining the card, you’ll have to look at your spending habits, payment history, and use. If you neglect to keep good financial habits, your credit score would certainly drop. Besides, sending your program authorizes the issuer to execute a hard inquiry which affects your score. The more your application flops, the more inquiries are added to a report. In regards to having a credit card, many issuing firms have incredibly stringent regulations. If you don’t stick to the strict regulations, you will undoubtedly get influenced by the results.

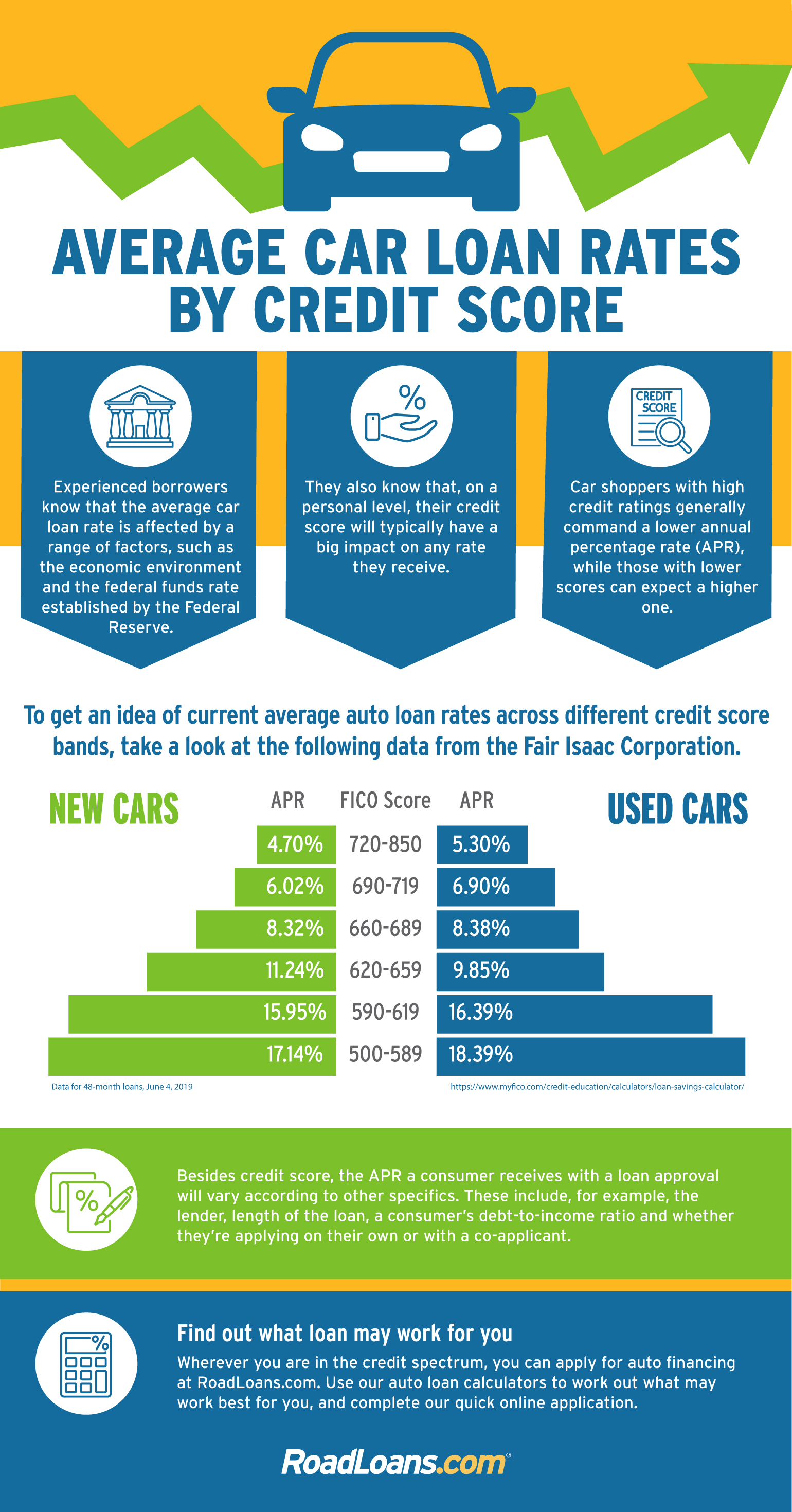

Among those questions that you may be having is whether obtaining a loan can hurt your credit score. Primarily, how that you manage loans is a vital part in determining your credit score. Because credit calculation models are usually complicated, loans can either tank or boost your credit rating. If you continuously default on your payments, your credit rating will undoubtedly drop. Your credit report is a snap that lenders use to determine whether you are creditworthy. This preliminary examination might be counterintuitive as you need a loan to build a fantastic history. When this loan program is the first one, your odds of success might be very slim. For this reason, you’ll need a loan to be eligible to get another loan. If you have had a good payment history in the past, the loan issuer may think about your program. However, if you have a history of defaulting, potential lenders may question your capacity to pay. Applying for a new loan may allow you to fix a severely broken credit. Since debt volume accounts for

Among those questions that you may be having is whether obtaining a loan can hurt your credit score. Primarily, how that you manage loans is a vital part in determining your credit score. Because credit calculation models are usually complicated, loans can either tank or boost your credit rating. If you continuously default on your payments, your credit rating will undoubtedly drop. Your credit report is a snap that lenders use to determine whether you are creditworthy. This preliminary examination might be counterintuitive as you need a loan to build a fantastic history. When this loan program is the first one, your odds of success might be very slim. For this reason, you’ll need a loan to be eligible to get another loan. If you have had a good payment history in the past, the loan issuer may think about your program. However, if you have a history of defaulting, potential lenders may question your capacity to pay. Applying for a new loan may allow you to fix a severely broken credit. Since debt volume accounts for