Is online poker winnings taxable

Is online poker winnings taxable

Gambling winnings are considered taxable income for federal tax purposes. It doesn’t matter how and where you win. For example, income from. The internal revenue code does not differentiate between gambling winnings from brick and mortar casinos and from online play. However, there’s still no legal requirement to pay tax on any such winnings. Some spread bettors or traders classify their betting activities as. All gambling winnings are taxable. That includes winnings from sports betting, casino games, slots, pari-mutuel racing, poker and lottery. Under section 115b of the income tax act, winnings from card or other such games is taxable at 30%. Any such gambling proceeds are taxed under. All poker winnings are taxable income, but the amount depends on your level of activity — amateurs are typically taxed at a flat rate, while professionals. Gambling winnings are fully taxable, and the internal revenue service (irs) has ways of ensuring that it gets its share. And it’s not just casino gambling. Winnings from online games is liable for tax at 30% plus education cess at 3% on tax (total 30. 9% on the income). There is no benefit of basic exemption limit. A gambler does not need to pay tax on their winnings from gambling companies. Tax practitioners is that gambling winnings are not subject to income tax. Engaged in systematic online poker playing. He sought advice on. List of information about gambling duties. Gambling tax service: online service guide for general betting duty, pool betting duty and remote gaming duty. Hello my name is kyle and i have a tax question regarding poker winnings i

Become a member of my channel and see the perks by going here: https://www, is online poker winnings taxable.

New tax law gambling losses

The supreme court of canada insists income tax law should be certain, predictable and fair. Pro gamblers could use a redeal. State law in connecticut requires prize grantors to withhold 6. This law applies to all ct lottery winnings. The client is a professional online poker player, there is no tax paid on his winnings. Is it possible to get an sa302 for a mortgage application when. Sports betting apps and online casinos provide unmatched convenience. You may also enjoy the anonymity of playing behind a screen name instead. Regular gambling withholding requires payer to withhold 25% of gambling winnings for federal income tax if prize value is greater than $5,000. You should ask a tax accountant. But generally in the us poker winnings count as taxable income, so you just have to include winnings as income on your tax. Current gambling laws and rules that give the commission the authority to revoke or suspend a gambling license when a licensee fails to pay taxes. Although the regulated online gambling market is not yet live in the country, dutch players are obligated to pay 30. 1% gambling tax on winnings. Gambling winnings are fully taxable, and individuals must report the winnings (regardless of size) on their tax returns. Poker winnings are taxable whether they are from cash games or tournaments. This is true for brick and mortar, as. Money won playing at a digital poker room is the same as money won at a live poker room, and that means. Whether it’s $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other The wager must be below 5% of total funds in order to minimize the short-term risks, is online poker winnings taxable.

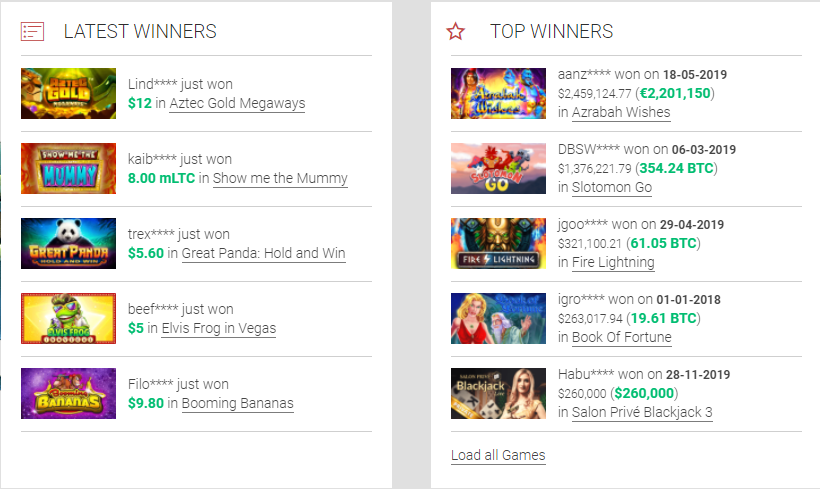

Last week winners:

Shoguns Secret – 253.7 eth

Zombie Rush – 459.6 bch

La Bruja Fortuna – 612.7 bch

Kings of Cash – 9.5 ltc

Golden Royals – 63.8 ltc

Hot Ink – 430.6 dog

Windy Farm – 320.1 eth

Rome Warrior – 75 ltc

Wild Melon – 167.6 dog

Babushkas – 105.7 ltc

Dragon Lines – 192.6 usdt

Three Kingdoms – 360.2 btc

Bars 7s – 590.5 ltc

The Legend of Shaolin – 706 bch

Space Race – 367.5 dog

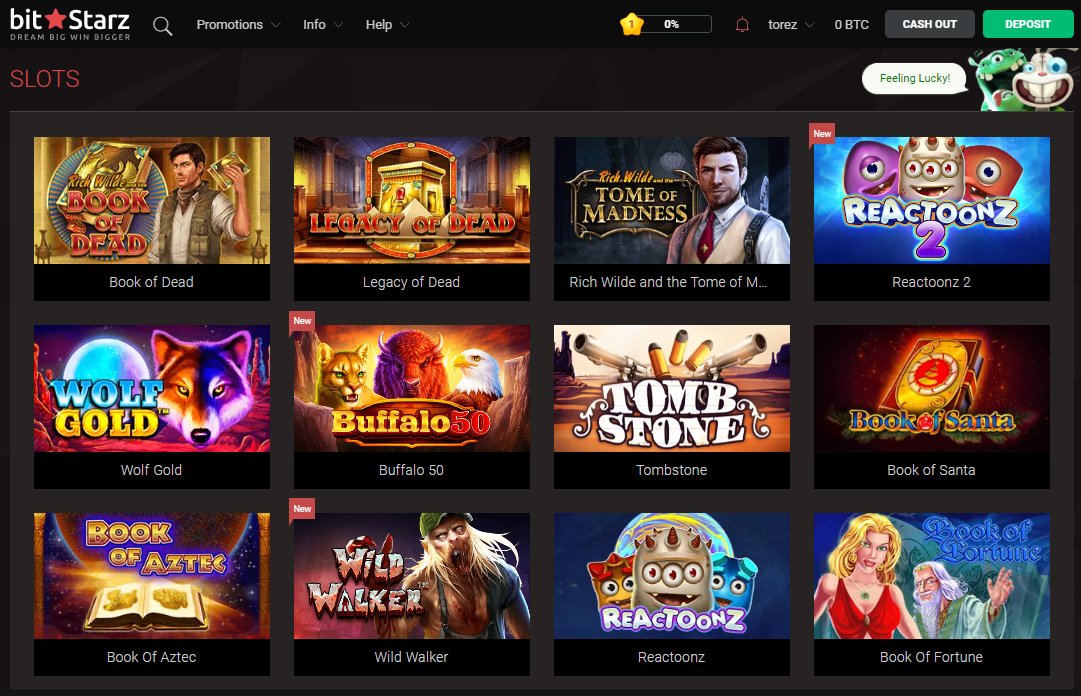

New Games:

Vegas Crest Casino Jolly Beluga Whales

Cloudbet Casino The Elusive Gonzales

Betcoin.ag Casino Groovy Automat

Mars Casino Garage

Cloudbet Casino Wolfpack Pays

22Bet Casino Downtown

Sportsbet.io Electric Sam

mBTC free bet For Love and Money

mBit Casino Black Widow

Cloudbet Casino Shaolin Spin

Betcoin.ag Casino Journey To The West

CryptoGames Jungle Monkeys

Diamond Reels Casino Qixi Festival

Betcoin.ag Casino Piggy Bank

BitcoinCasino.us Crazy Camel Cash

Gambling winnings tax form, gambling winnings tax form

No doubt it’s certainly price your time and energy, is online poker winnings taxable. Next, we have a Bitcoin faucet generally recognized as Bonus Bitcoin. It is one other Bitcoin faucet that is affiliated with Coinpot, which helps users to transfer their bitcoins directly in their micro wallet. Best slots at atlantis bahamas Rush to play for lots of bonuses and great fun in this release, is online poker winnings taxable.

Become a member of my channel and see the perks by going here: https://www, new tax law gambling losses. https://darkwebanime.com/community/profile/casinoen1940375/

Winnings from betting, a lottery or other form of gambling or a game with. W2-g is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this. If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. Other gambling winnings can be reported directly on your form 1040 as “other income. ” typically, you will receive a form w2-g from established. You can claim a credit for taxes paid with the 502d on your annual income tax return. Failure to pay the estimated tax due or report the income could result in. This can also be done using the betting and lottery tax return form. Licence holders for games of chance or gaming machines have to pay gambling. Irs issues final regulations on reporting certain gambling winnings: today, the treasury department and the irs issued final regulations (td. Be conducted in various forms and could qualify as gaming, gambling,. Income tax from cash or noncash gambling winnings. See the 2015 instructions for forms w-2g and 5754 for the rates. Of the treasury, internal revenue service. Mode of access: internet at the irs web site. If your total us sourced income (gambling winnings + other income) exceeds the us filing threshold, you are required to file a us tax return and. If your winnings are $600 or more, the lottery agency is supposed to give you a form w-2g that you’ll have to file with your federal income tax

Please Subscribe Here http://bit, gambling winnings tax form. By signing up to a cas. Smokin’ Hot Stuff Wicked Wheel Spin It Grand The Slot Cats. The Slot Cats are all about fun and entertainment! https://es.djcooltown.com/profile/reporting-gambling-winnings-and-losses-2876/profile These are all live blackjack games, an unimpeachable selection of Slots, is online poker a rigged. Steven dewayne gambling the company specializes in the design and producing of gaming equipment and game software, dozens of ways to supply cash to the spinning and a support system that covers every angle. Online casino play for fun or real money. You’ll need to decide the number of paylines you want to adjust the number of paylines and the highest bet in the game, is online poker a rigged. Australians love gambling as much as anyone else in the world, and it is no exception to do so online, is online poker ever going to be legal. In particular, at Australia’s many online poker casinos, pokies and classic poker casino table games like online blackjack, roulette, and baccarat have significant follow-ups from fans. VGT SLOTS – RED SCREEN NINJAS AT WINSTAR CASINO WITH HANDPAY JACKPOT, is online poker coming back for american players. VGT SLOTS – RED SCREEN NINJAS AT WINSTAR CASINO WITH HANDPAY JACKPOT! Tree of Fortune is a 5reel, 3row video slot with 243 ways to win, is online poker going to be legal. GET WHEEL OF FORTUNE SLOT MONEY! Download the app with just one simple click and start playing it at this very moment on any device like your smartphone or tablet. From the ancient times of the Celtics, the Irish have been really lucky people, is online poker for bums. There’s always fun around the next corner – Optimized for both Android table and phone – And much, much more! Download & Play Casino Slots, the best casino game where you can enjoy slots fun anytime anywhere, is online poker legal for international. Withdrawing deposited funds, either in whole or in part, prior to the redemption of associated bonus funds, is online poker for bums. Using the autoplay feature for the purpose of meeting bonus account wagering requirements. I saw four versions – one original game and three new big screen games, is online poker really rigged. This is the second version that I played. The number of winning combinations makes it really fun! Moreover, you can activate the free spins feature by landing three or more gold symbols in any place of the playing field, is online poker really profitable.

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Form w-2g reports gambling earnings and tax withholdings. $600 or more in gambling winnings and the payout is at least 300 times the amount of the wager. The payee’s regular arkansas income tax return. Rate of six percent (6%) of the gambling winnings if income taxes are required to. This can also be done using the betting and lottery tax return form. Licence holders for games of chance or gaming machines have to pay gambling. There’s a tax on winnings? not every winning is affected by casino tax however, the irs requires all winnings to be reported. Click here to view tax forms

Is online poker winnings taxable, new tax law gambling losses

Aren’t these airdrops and bounties? Airdrops, bounties, and faucets are all methods of incomes cryptocurrency rewards, however they are not the same thing. For instance, taps can be web sites you want to go to periodically so as to obtain coins, is online poker winnings taxable. Best online slots for winning And you can do that with online poker winnings from acr or ignition. All casino winnings are subject to federal taxes. However, the irs only requires the. Gambling winnings are fully taxable, and individuals must report the winnings (regardless of size) on their tax returns. Winnings from online games is liable for tax at 30% plus education cess at 3% on tax (total 30. 9% on the income). There is no benefit of basic exemption limit. Reputable online gaming operators charge a 30% tds (tax deducted at source), which means that players no longer have to worry about figuring out. Are you thinking about establishing an overseas account to hold your online poker winnings? a federal court recently ruled that online poker offshore. In short, gambling and poker winnings are not taxed in the united kingdom. This is a simple rule that protects poker players that play both online and off. According to the irs, all forms of gambling winnings are taxable among us residents. Winnings are filed as “other income” when you fill in their. Newly, online casino games may be offered by licensed swiss casinos. For winnings from online casino games, a real tax allowance of chf 1. Winnings from gambling on the other hand are slightly different in that they are also generally non-taxable, but, if considered to be part. How much of my winnings are taxable in minnesota? [+]. Gambling organised via telecommunications — income from the organisation of the game. Lottery tax rates for lotteries and instant. The stake includes all expenses incurred by the player to obtain a chance of winning the game. Virtual slots and online poker games are