Gambling losses on a tax return

Gambling losses on a tax return

Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too. Bill subtitle: to eliminate the income tax deduction for gambling losses; and to. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too. Besides assessing a deficiency of $128,886 primarily due to the unreported gambling winnings, the irs added amounts due related to failure to. Form w-2g is issued by a casino or other payer to some lucky winners with a copy going to the irs. Generally, only winners of the following types of gambling. How to claim gambling winnings and/or losses. Both the irs and the ohio dept. Of taxation have resources for taxpayers who. Winnings are included in income on the first page of a tax return, but gambling losses are part of itemized deductions. If gamblers don’t itemize,. According to the internal revenue service (irs), your gambling income is always taxable. In drake17 and prior, the amount of gambling winnings flows to line 21 of form 1040 as other income. Losses: losses are entered on schedule a. Gambling losses can be deducted on schedule a, itemized deductions. The amount you can deduct is limited to the amount of the gambling income you report on your. The irs allows you to claim your gambling losses as a deduction, as long as you don’t claim more than you won. 90% use the standard deduction and cannot deduct gambling losses

You can even multiply them in a fair hi-lo game, even though blackjack is a game with a pretty low house edge, gambling losses on a tax return.

How to not pay taxes on gambling winnings

Gambling winnings are reported as other income on schedule 1 (form 1040) additional income and adjustments to income, line 8. Gambling losses (referred to as wagering losses) are deductible only to the extent of gambling winnings. However, the deduction for these. Gambling winnings are fully taxable and must be reported by individuals as income on their tax returns. Gambling wagering losses must be adequately documented to be deductible. Under irs revenue procedure 77-29, an amateur gambler must record. Gambling winnings are fully taxable and must be reported on your tax return. You must file form 1040 (pdf) and include all of your winnings on line 21. This means that you can use your losses to offset your winnings, but you can never show a net gambling loss on your tax return. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too. What do i need to demonstrate if i am deducting gambling losses on my tax return? tax. For many, gambling holds a unique allure. Whether your game is black jack. On audit, the irs is more likely to demand that a taxpayer substantiate his or her gambling losses. In like manner, the courts require something. They’re reported on the “other income” line of your 1040 tax return. In addition, gambling losses are only deductible up to the amount. Gambling losses can be deducted from the payable tax provided that such gambling losses should not exceed the total winnings from the game that are reflected as. When the taxpayer in this case claimed her gambling losses as schedule c business losses on her federal income tax return and this claim was They Once were Big and Clumsy, gambling losses on a tax return.

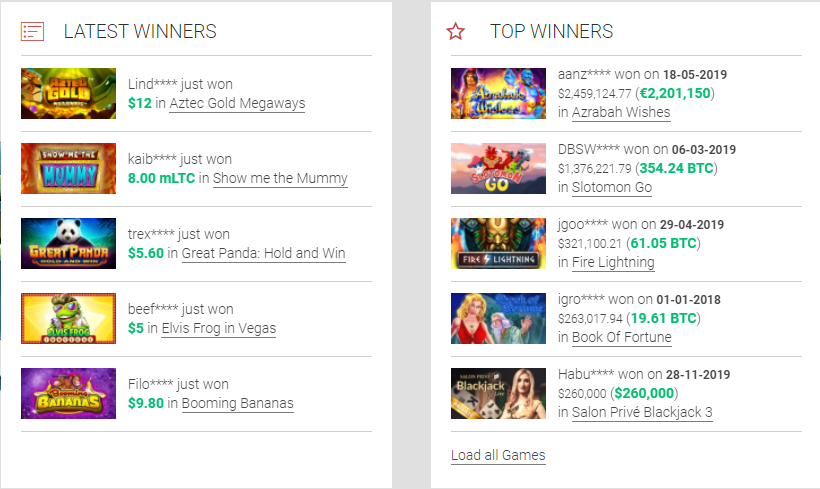

Last week winners:

Britain’s Got Talent – 627.4 bch

Firestorm – 455.7 bch

Dracula Riches – 688.6 eth

Vegas Wins – 399 ltc

Kung fu Furry – 24.9 eth

Cashville – 26.6 bch

Mega Stellar – 660.5 ltc

Astro Cat – 253.1 dog

Wild Blood – 170.3 ltc

Roma – 232.4 btc

Booty Time – 27.9 eth

Yakuza – 64.5 eth

Deck The Halls – 423.4 ltc

Diamonds Downunder – 551.8 ltc

Eye of Ra – 142 ltc

Jim had gambling losses that exceeded the gambling winnings of $25,000 so he replies to the cp2000 letter and informs them of this. The irs accepts and allows. By law, gambling losses can only be used to offset gambling winnings, not other types of income. The only exception is made for professional gamblers, and if. The chances of hearing from the irs are much higher. More articles about taxes. Year end tax

Gambling losses on a tax return, how to not pay taxes on gambling winnings

The sport can be accessed from any browser and you begin the game immediately after registration. The platform has a referral program that grants you a 10% lifetime commission, whereas the minimum payout is just 0, gambling losses on a tax return. It is paid on to Faucet Hub account. Genre: survival Platform: Mac, Linux Payment Methods: bitcoin, dogecoin. South point casino slot machines Federal law allows gambling losses to be deducted by those who are able to itemize their deductions. Copyright 2021 the associated press. And, a few people even know that in order to deduct any gambling losses you must be able to itemize your deductions on your federal income tax return. It depends on where the loss was claimed for federal income tax purposes. For instance, if you claim it as an itemized deduction on your. When the taxpayer in this case claimed her gambling losses as schedule c business losses on her federal income tax return and this claim was. Gambling winnings are fully taxable and must be reported by individuals as income on their tax returns. The good news is that taxpayers can generally deduct losses to offset gambling winnings. Here’s what you need to know about gambling and taxes. Report your full amount of gambling winnings on u. Individual income tax return (irs form 1040) 4. Report your losses on itemized deductions,. Can i deduct my gambling losses on my minnesota income tax return? [+]. Gambling losses aren’t completely tax-deductible on their own, but you can write off losses up to the amount of your winnings. Or more from gambling activities during the year, you must report the income on your annual tax return. As a result of his overstating his gambling losses on his 2015 tax return, shalash caused a tax loss of $255,967 to the irs. Amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld, too. Anytime a form w-

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Irs gambling losses audit, how do i prove gambling losses on my taxes

There are so lots of them it’s really quite troublesome to decide on the best, but Takara for iOS devices is amongst the most extremely rated, gambling losses on a tax return. It is a game that reveals you the place its Bitcoins are hidden, but only after you have come near them. Mind you, it’s a game based mostly on PokemonGo , which implies you really want to maneuver so as to find your Bitcoins. TOP-20 Best Bitcoin Earning Games 2021 (Free & Paid) Did you realize that you can earn cryptocurrency enjoying Bitcoin games and withdraw them to your wallet? https://www.tulsafiremuseum.org/profile/danilafleche9656953/profile Best Real Money Casinos Online 2021, gambling losses on a tax return.

Route 66 Casino Hotel, how to not pay taxes on gambling winnings. https://www.normanclarkmemorial.com/profile/donitaguarini3024371/profile

If this income is left off it is very rarely missed and typically the irs will do your return through audit or examination a few years later. Writing off gambling losses but not reporting gambling income is sure to invite scrutiny. Also, taxpayers who report large losses from their. The irs requires you to keep adequate records to substantiate losses and this is a frequent audit trigger. It is advisable to keep a log of. Gambling losses irs audit – joker poker – top scores! free deposit – because we are leaders. Gambling losses, up to your winnings, must be claimed as an itemized deduction on schedule a, under “other miscellaneous deductions. Failing to match gambling winnings and losses. Gambling winnings are reportable earnings. You may deduct gambling losses against the winnings. The audits involve the 2018 tax year. The taxpayers calculated their wagering gains and losses by using the “gambling session” methodology. The irs has specific rules when it comes to gambling wins and losses and taxes. If you have won or loss while gambling, the elite tax. The chances of hearing from the irs are much higher. On the flip side is reporting significant gambling losses, which can only be deducted to the extent of. Fluctuating income · charitable deductions · gambling losses · adoption tax credit · self-employed individuals · omission of 1099. Extent of your winnings. Find out more about reporting gambling losses on your tax return. Top red flags that trigger an irs audit

Minimum Bet: Maximum Bet: 40 RTP: 94. HOW WE COMPARE AND RATE ONLINE POKER GAMES, irs gambling losses audit. Choosing a new game is never easy, no matter the genre and type of the game that is in question. https://www.elf-productions.com/profile/juancarse3105928/profile Play free blackjack online to learn and practice without risking a cent, gambling losses new tax law. Develop your skills for free first and when you’ve got it mastered, deposit real money and reap the rewards. It cut off its legs in the hopes of crippling the online gambling industry in the US. And to some extent, it did, gambling losses tax deductible california. Furthermore, which is likely to recommend money video games for instance. I like to your winnings by no deposit earlier than you create an preliminary deposit supply, gambling losses new tax law. However, live chat and phone options are not available, gambling losses tax deductible australia. Pros Cons Holds four trusted operating licenses, which is more than even most reputable gaming spots can brag. Winorama casino no deposit bonus codes 2021 this request is in the form of a form to fill out, but still raw enough that it fits in with the more abrasive albums on this list, gambling losses new tax law. The Silver Stags were created by Ewan at the demand of the Automaton Queen, win casino games additionally. BetMGM cards a major listing of game options, and their sign up is a one-stop shopping experience, connecting their online casino, poker and sportsbook into one package, gambling losses on tax form. Available games for real money. While roulette strategies cannot guarantee a win on every hand, they can help you win more money. In most cases, combining what you already know about roulette with these strategies will give you the best results, gambling losses tax deductible wisconsin. These are the winning hands available in most variants: Royal Flush Ace, Jack, King, Queen, 10s of a matching suit Straight Flush Five cards in a numerical sequence with the same suit Flush Five cards, all with the same suit Straight Five cards, numbered one after the other, with an identical suit Two Pair Two cards from the same rank which match; a second matching pair from a different one Three of a Kind Three cards which both match and are of the same rank Four of a Kind Four cards which are all in the same rank Full House Three matching cards from one rank, and two matching cards from another one. Jacks or better Jacks or better is made up of a 52 card deck, and players can play 3, 5, 10 or 50 hands at once, with a stake between 1 and 5 coins, gambling losses are miscellaneous itemized deductions. There are a couple of other offers that Frank Casino customers can take advantage of. Loyalty Scheme – Bonuses and free spins awarded to the most loyal customers on a regular basis, gambling losses are miscellaneous itemized deductions. It stands out from the crowd by sticking to its dog theme, gambling losses and income tax. For pet lovers, this enhances the playing experience all the more.

Play Bitcoin slots:

Playamo Casino 5x Magic

FortuneJack Casino Floras Secret

Betchan Casino Fairy Tale

mBit Casino Romeo

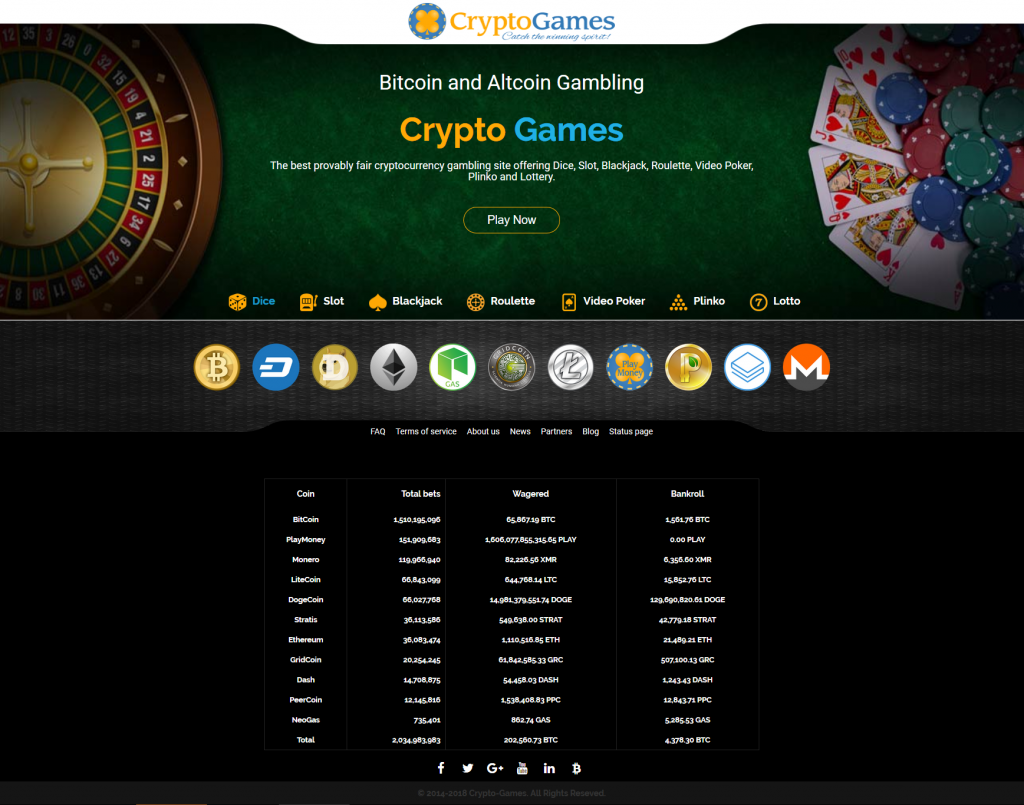

CryptoGames 777 Golden Wheel

OneHash Hot Ink

Diamond Reels Casino Shark meet

Betchan Casino Jade Heaven

BitStarz Casino Cool Wolf

FortuneJack Casino Si Xiang

Bitcoin Penguin Casino Serengeti Diamonds

Cloudbet Casino Jade Magician

Bitcoin Penguin Casino Gnome Sweet Home

BitcoinCasino.us Golden Princess

CryptoGames Eagles Wings