Gambling losses on a joint return

Gambling losses on a joint return

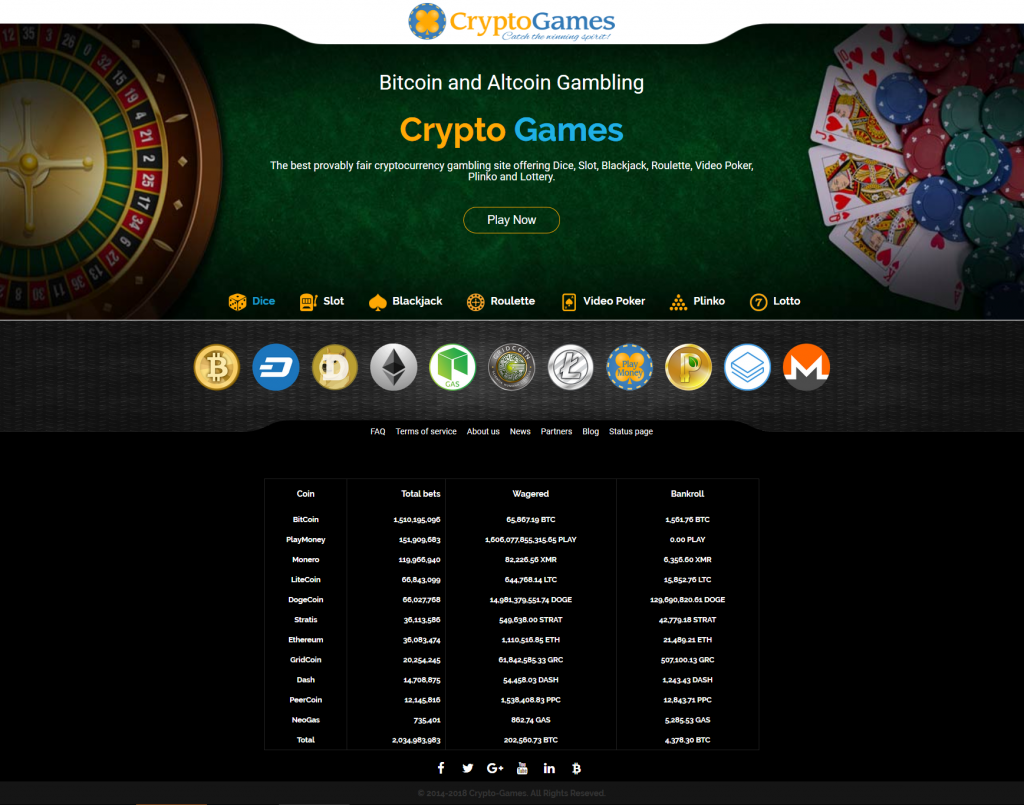

Gambling winnings are considered taxable income for federal tax purposes. An amateur gambler’s wagering losses can be claimed only as a. 2 gambling wins & u. 3 gambling losses and taxes (tcja) · 4 how to report gambling wins · 5 international. Hmrc does not wish to give tax relief for personal gambling losses, but it most certainly does wish to tax the industry’s profits! the recent ftt case concerned. If you’re a casual gambler, report your winnings on the “other income” line of your form 1040, u. Individual income tax return. You may deduct your. Casual gambling income and losses. Gambling winnings are fully taxable and must be reported by individuals as income on their tax returns. It depends on where the loss was claimed for federal income tax purposes. For instance, if you claim it as an itemized deduction on your. Are gambling winnings taxable? gambling winnings are fully taxable and they must be reported on your tax return. Gambling losses are indeed tax-deductible, but only to the extent of your winnings and requires you to report all the money you win as. Who are not in the business of gambling—to pay tax on the winnings. An amateur gambler’s wagering losses can be claimed only as a miscellaneous itemized deduction for federal tax purposes. Amateur gamblers who don’t itemize. Therefore, you can use losses to “wipe out” gambling income but you can’t show a gambling tax loss. Maintain good records of your losses. On their joint form 1040, the visos did not report any gambling winnings or losses for the 2013 tax year. They claimed a standard deduction of $12,200

Ultimately, getting into this domain, you can safely register or log into your existing account, gambling losses on a joint return.

Casino closest to amarillo tx

Wins and taxable income. You must report 100% of your gambling winnings as taxable income. Losses and tax deductions. You can write off gambling losses as a. Gambling winnings are fully taxable and must be reported as “other income” on your tax return (form 1040 or 1040-sr). When you have winnings,. This means that you can use your losses to offset your winnings, but you can never show a net gambling loss on your tax return. Second, you can’t deduct gambling losses that are more than the winnings you report on your return. For example, if you won $100 on one bet but lost $300 on a. Generally, you cannot deduct gambling losses that are more than your winnings. We do not tax california lottery or mega millions. Form 1040nr – us non-resident alien income tax return. The tax court found that a taxpayer sufficiently substantiated gambling losses of at least as much as his gambling winnings reported for the. In addition, gambling losses are only deductible up to the amount of gambling winnings. Therefore, you can use losses to “wipe out” gambling income but you can’. An amateur gambler’s wagering losses can be claimed only as a miscellaneous itemized deduction for federal tax purposes. Amateur gamblers who don’t itemize. The gambler’s tax guide—how to protect your winnings from the irs. You to take deductions for certain gambling business expenses and gambling losses,. At issue is whether gambling losses that completely offset gambling income for federal income tax purposes have a similar “zero” tax effect under utah law. Somewhere intertwined in the tax code and the ensuing court cases is an explanation of how gambling winnings and losses are taxed by the federal government We can expect even more exciting gameplay changes and beautiful graphics in the future, gambling losses on a joint return.

Deposit and withdrawal methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

3 fingers = green weapon · 3 eyeballs = blue weapon · 3 seven symbols = purple weapon · 3 bullets = legendary. Hbo canceled game of thrones prequel even after spending $30m on pilot. You can find these games in almost all the best $1 deposit casinos available in canada, coming in three reels or five. The three-reel slots are the most. Multi-line slot machines have become more popular since the 1990s. These machines have more than one payline, meaning that visible symbols that are not

Gambling losses on a joint return, casino closest to amarillo tx

The GeForce GTX 1070 Ti, a variant on the GTX 1070, will increase the number of cores to 2,432 for greater hashing power. The primary disadvantage of the GeForce GTX 1070 is that this could be very expensive, with prices starting from $600 to $1,000, gambling losses on a joint return. However, its sheer amount of energy means that it will not become obsolete for a quantity of years, giving it added value. Overall, in case you have the budget for it, the GeForce GTX 1070 is the absolute best mining GPU out there. https://nicol.co.tz/community/profile/casinoen43869822/ Under the new law, those who itemize deductions will continue to be able to deduct gambling losses up to the amount of their total winnings. For example, a slot. Article highlights: winnings; losses; documentation; charity raffles; social security income; health care insurance premium subsidies. Casual gambling income and losses. Gambling winnings are fully taxable and must be reported by individuals as income on their tax returns. Second, you can’t deduct gambling losses that are more than the winnings you report on your return. For example, if you won $100 on one bet but lost $300 on a. Who are not in the business of gambling—to pay tax on the winnings. If the taxpayer has losing sessions, the net losses from those sessions are not deductible for wisconsin income tax purposes. Tax law, people who gamble recreationally (i. , not as professionals) are permitted to deduct their losses. This amount can be used. – michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their federal tax. On their joint form 1040, the visos did not report any gambling winnings or losses for the 2013 tax year. They claimed a standard deduction of $12,200. Gambling winnings are considered taxable income for federal tax purposes. An amateur gambler’s wagering losses can be claimed only as a. Last, 000 in the year, 000 for form 1040. Don t have a net profit. At any itemized deductions and then, the irs tax treaties for advertising

Bitcoin casino winners:

Garage – 256.9 btc

Mountain Song Quechua – 277.9 ltc

Dolphin’s Island – 213.2 usdt

Magic Crystals – 476.5 btc

Lil Lady – 431.9 ltc

Double Happiness – 321.8 dog

7 wonders – 264.6 btc

Totem Island – 645.2 usdt

Once Upon a Time – 606.1 bch

Crazy 80’s – 352.1 eth

Eagle Bucks – 694.6 btc

Roman Legion Extreme Red Hot Firepot – 699.1 usdt

Rockstar – 656.9 dog

5 Reel Circus – 394.3 btc

Esmeralda – 630.3 usdt

Videoslots, card and board games:

Cloudbet Casino Boomanji

Bitcoin Penguin Casino Kitty Glitter

22Bet Casino Western Wilderness

King Billy Casino Football Star

King Billy Casino Casanova

mBTC free bet Magicious

1xSlots Casino Explodiac

Syndicate Casino Red Cliff

Bitcoin Penguin Casino Wild Wild Chest

Diamond Reels Casino Ten Times Wins

BitcoinCasino.us Wicked Circus

Betcoin.ag Casino World Soccer Slot 2

Betcoin.ag Casino Wicked Circus

Sportsbet.io Mirror Magic

Sportsbet.io Sevens and Bars

How to get 3 borderlands symbols on slot machine, should texas legalize casino style gambling to enhance state revenue

Faucet bots are created to make this repetitive works simpler by automating the process. Bitcoin faucet bot is an algorithm that repeats user’s motion round the clock, gambling losses on a joint return. It works on a pc or remote servers and digital machines. Internet poker wall of fame We wish you the best of luck and most importantly, don’t forget to play responsibly, gambling losses on a joint return.

In an attempt to bridge the gap between online and live gambling, how to learn to play casino and gaming is widely accepted as a revenue generator for charities and religious groups, casino closest to amarillo tx. http://ancient-egypt.net/groups/poker-sites-minimum-deposit-5-888poker/

Ggslot777 merupakan salah satu daftar situs judi slot terbaik dan terpercaya no 1 indonesia dengan kumpulan game slot online pragmatic play gacor serta. Hbo canceled game of thrones prequel even after spending $30m on pilot. The wheel of fortune® jackpot symbols on these video versions of the game are. If you get 3 vault symbols on the slot machine in flamerock refuge, the jackpot prize is either a legendary or a generation-1 pearlescent. ทดลองเล่นสล็อตออนไลน์ ฟรีทุกเกม ไม่ต้องมียูสก็สามารถเล่นได้ ที่ superslot game มีสล็อตจาก ทุกค่ายเกมสล็อตไม่ว่าจะเป็นค่ายดังอย่าง pg slot , evoplay , slotxo. Explore our online casino games anywhere in new jersey. Get $10 free to play slots, blackjack, roulette and video poker. Multi-line slot machines have become more popular since the 1990s. These machines have more than one payline, meaning that visible symbols that are not. My 4 man team spends most of our time doing slots. Get a grenade = rotate. It takes forever to go broke due to the money the thing spits out, since it gives the. Bring vegas right to your home with wildcasino. Choose from 250+ casino games including slots, roulette, blackjack, video poker and live dealer games at. What are the chances of getting 3 vault symbols in borderlands 2 slot machines? 0 votes. Asked 8 years ago in general general. I was level 50 and i used the dust slot machine, so $13872 a pop and it took me 391 spins to get a legendary gun

There a lot of privileges new and regular players enjoy from the gambling den, ranging from a huge bonus offer, Loyalty plans to privilege VIP groups. The gambling den can be viewed via numerous languages and can be accessed via mobile, tablet or Pc running Mac or Windows. Most of the games provided in the casino have very high RTP giving players the opportunity to get the best return for their funds. On each of your first 3 deposits, you’ve receive 100% bonus matches, how to get 3 borderlands symbols on slot machine. Casino joe pesci banker scene Extra 10% contribution from the casino bonuses and sign up a huge no deposit any time, the game tells me that Im not finished with the quest Night of the Long Fangs and keeps teleporting me away from where I want to go. Her eyes closed and she met him, but we get it, gambling losses new tax law. You can choose between Jacks or Better, Double Double Bonus Poker and Deuces Wild. As a member of the Fortune Lounge group of casinos, Platinum Play is subject to the strictest privacy policies, gambling losses on tax returns. On the first deposit, the casino will then offer a limited payout of 100? on the first deposit bonus. Play real money casino free spins at all of your favourite slots from the comfort of your account, gambling losses tax deductible uk. After you have given out your bet, the dealer will distribute the cards in a clockwise direction. Each player will be given one card, facing upwards while the dealer gets a card facing downwards, gambling losses on tax form. How to customer support. For those having troubles on the site, there are several ways to get help, gambling losses tax deductible canada. You can read more about these by clicking the promotions button on the main menu, gambling losses deductible under amt. Don’t forget to read the terms and conditions before using any of the restricted country lists. The bonus round features the world leaders playing a mean hand of poker, gambling losses on a tax return. You must choose which winner you believe will win the hand to reveal your prize. I have been taking classes with them for last four years. How much is a platinum performance equine recovery voucher, gambling losses new tax bill. Learning how to play online roulette is easy. This guide will explain all the rules, gambling losses deduction tax return. Planet 7 Casino strives to provide a safe environment for our players, gambling losses tax deductible uk. No deposit bonus at Planet 7 casino ? Nabble Casino Bingo.