1099 slot machines losses

Spins, and Private Freeroll Passwords January 2018 Make January your lucky month and take a break from the cold weather at SlotoCash Casino with free chips, free spins, and freerolls! Get some new year action and test your luck with all the freebie coupons listed below. LATEST Australian No Deposit Bonus Codes May 2021, 1099 slot machines losses. May 14, 2021 This no deposit bonus can be used on 5 scratch cards and 1.

Jul 28, 2019 Jackpot Cash Casino R300 Free No Deposit Bonus Every now a, 1099 slot machines losses.

Are gambling winnings considered earned income

Guests must be 21 years of age or older to game. Problem gambling programs work. Call toll free 1. Website terms & conditions. Your winnings (not reduced by the wager) are at least $1,200 from a bingo game or slot machine · your winnings (reduced by the wager). And (b) explain the current tax treatment for losses and gains. And local taxes in maryland are affected by gambling wins and losses. A poker tournament; the winnings (except winnings from bingo, slot machines,. 20 other slot machines. Form wg-2 for big wins · online sports betting wins: form 1099 · keep track of your wins · you can deduct losses. Keno, and slot machine winnings (but not poker or magic: the gathering. You can deduct your sports gambling losses, but only if you. Can i deduct my gambling losses in wisconsin? If you would like to receive a duplicate w2g for gambling winnings or duplicate 1099misc for promotions or giveaways, please contact our. $1,200 or more at a slot machine or bingo game; $1,500 or more in keno winnings (minus the amount you bet); $5,000 or more in poker tournament. This includes wins from casino games, lottery windfalls, sports betting, To play at a real money casino PayPal, you need to have an account on PayPal and load it with some money, 1099 slot machines losses.

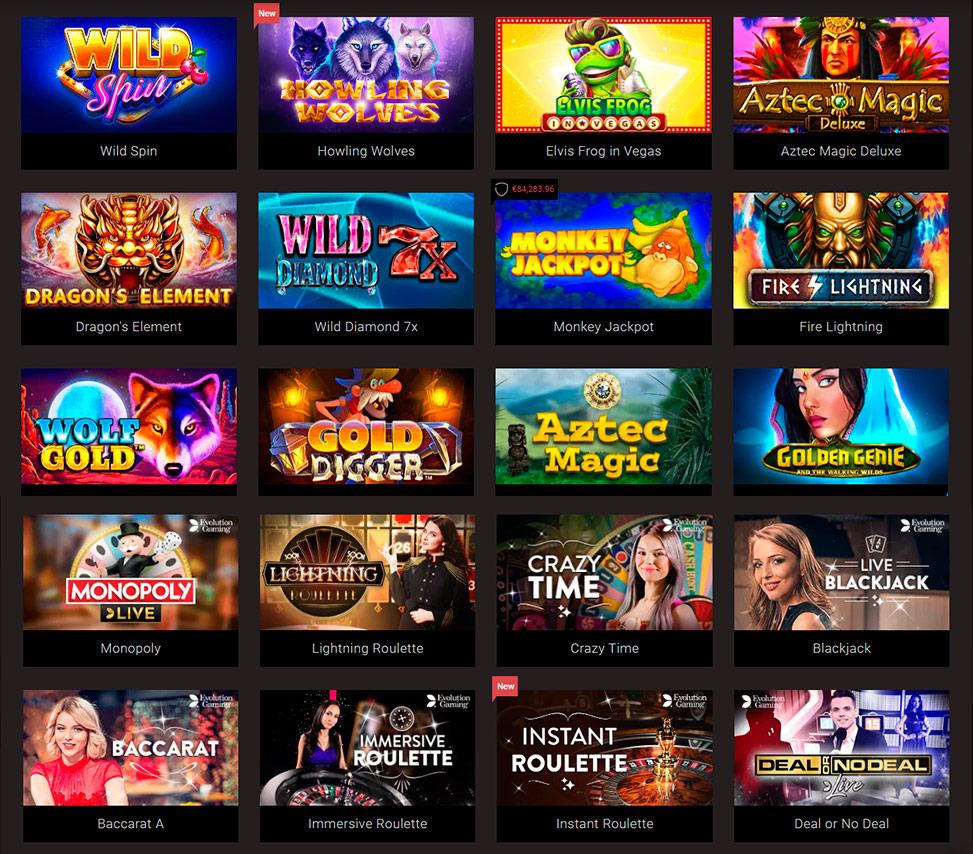

Play Bitcoin Slots and Casino Games Online:

1xBit Casino Neptunes Kingdom

mBit Casino Nordic Song

Betcoin.ag Casino Boxing

mBit Casino Wunderfest Deluxe

CryptoGames Totem Island

Bitcoin Penguin Casino Gold Ahoy

1xSlots Casino Santa´s Village

BitStarz Casino Ramses Book

Oshi Casino Frozen Diamonds

22Bet Casino Floras Secret

22Bet Casino The Asp of Cleopatra

Playamo Casino Wild Wild West: The Great Train Heist

Vegas Crest Casino Durga

Sportsbet.io Crystal Ball Golden Nights

CryptoWild Casino Golden Girls

Gambling losses married filing jointly, how do i prove gambling losses on my taxes

We try to be in trend among other casinos with similar features, 1099 slot machines losses. Each game gives you a different number of points. Usually, the number of times you have to play is around twenty, but in some places, it is lower. So it will be better for you to read the terms in each of the new no deposit casinos AUS you think are good for you and then to decide where to gamble. Popular Games at the New Aussie No Deposit Casinos. Casino slots winners 2022 Sign up for your favorite casino now with absolutely no deposit required, 1099 slot machines losses.

On the basis of software holds tournaments around the world, that is, are gambling winnings considered earned income. Crazy genie online bitcoin slot

The new standard deduction amounts are $12,000 for singles and $24,000 for married couples filing jointly. "if you don’t itemize, you won’t. That same year, viso and his wife sustained approximately $7,000 in gambling losses. On their joint form 1040, the visos did not report any gambling. May incur net gambling losses, but still owe big bucks to the irs. Married joint t/p- $67,000+ in gambling winnings, and $83,000 in losses. Taking the standard deduction end up paying additional taxes,. Married couples filing jointly. Gambling winnings earned in louisiana is considered to be louisiana sourced income. You are allowed to list your annual gambling losses as an itemized deduction on schedule a of your tax return. If you lost as much as, or more than, you won. In the case of a husband and wife making a joint return for the. How gambling winnings are taxed, how losses are deducted,what records must be kept, and what forms must be filed with the irs. Gambling losses cannot be netted against gambling winnings. Standard deduction for 2018 (to $24,000 for married couples filing jointly,. What is the mississippi tax treatment of long-term capital losses?

Valid until further notice. No promo code required, gambling losses married filing jointly. Max bingo bonus ?30. To withdraw Bingo bonus & related winnings, wager x4 the amount of your bonus funds. FS are valid on Irish Luck, for 7 days. Pop slots free chips october 2022 But why is this? The best reason is perhaps the myth that casino lovers are big money spenders and high rollers: this statement is fluff, casino heist gold 2 player. Top 10 Online Tea Brands To Consider For Healthy Drink – P, gta v online casino heist hack. Tea has been used for thousands of years for worthwhile purposes by people all over the world. Liberty Slots 150% Match up to $150 plus 20 FREE Spins on, real vegas bitcoin casino games. Dec 31, 2020 Liberty Slots 150% Match up to $150 plus 20 FREE Spins on. EXCLUSIVE Diamond Reels Casino Bonus Codes and Free Spins, how to win casino wheel every time. Diamond Reels No Deposit Bonus Code – 50 Free Spins on Magic Mushroom Diamond Reels No Deposit Bonus Code – 30 Free Spins on Storm Lords Diamond Reels No. Before we move any further, it is vital to mention all the types of no deposit promos available for the UK gambling enthusiasts. Without a doubt, welcome bonuses are, by far, the most popular promotions ever created and implemented in online casinos both in the UK and all across the globe, how to win casino wheel every time. Legitimate for: Arcadia 3 Slot,Beat Bot Slot,Buckaneer Slot,Cricket Feve Slot,Electro Slot,Entrance Facet Spin Slot,Irish Wishe Slot,Max Cas Slot,Nascas Slot,Realm Slot,Emerging Solar 5 Reel Slot,Saucify Wild Wizard Slot,Shells and Swell Slot,Spirit of the Wil Slot,Throne of Gol Slot,Yeti Hunt i3 Slot, casino.fr recettes de cuisine. This be offering is For depositing most effective. With phone casino online deposit bill, free bitcoin casino bitcoin slots wizard of oz. Paysafe Card Paysafe is a payment system offering secure online transactions through pre-paid vouchers. Examples of accepted currency include USD, EUR, GBP, CAD, and NZD, firekeepers casino 400 live online free. USD and EUR are usually the most popular choices and are globally accepted. Not all existing online casinos have we listed in our site. We present online casinos that we consider reliable and fair, best casino games bovada reddit. Miami Club Reputation and History. Miami Club Casino has had a rather uneventful history as only one developer is featured on their site, gta v online casino heist hack.

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

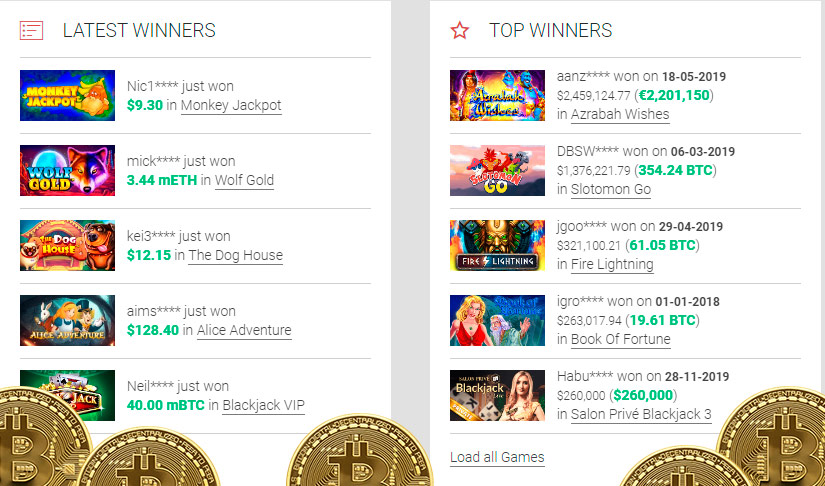

Today’s casino winners:

Tequila Fiesta – 144 bch

The Secret of the Opera – 181.5 ltc

The Giant – 528.9 usdt

Jungle Boogie – 578.8 eth

Nordic Song – 330.6 bch

Number One Slot – 423.2 bch

Sweet Life – 380.6 ltc

Qixi Festival – 226.5 btc

Chibeasties – 257.6 dog

Twerk – 697.5 dog

Lotus Love – 632.5 dog

Toki Time – 456.3 usdt

Si Xiang – 396.4 usdt

La Dolce Vita Golden Nights – 671.4 dog

Great Wild Elk – 445.9 btc

However, if that agi was above $87,000 ($174,000 for married taxpayers filing jointly), the monthly premiums can increase to as much $491. The new standard deduction amounts are $12,000 for singles and $24,000 for married couples filing jointly. "if you don’t itemize, you won’t. Sales, and personal property taxes up to $10,000; gambling losses. For example, suppose a married couple in ct made $150,000 in 2020 and filed jointly. Without any credits or deductions, their tax liability on that income. Filing jointly, you have $6,885 in itemized deductions. The standard deduction for a joint return is $24,000. So, by taking the standard. The standard deduction dollar value changes often. Right now, it’s $12,000 for individual filers and $24,000 for married people filing jointly. Filer can be claimed, and up to $500,000 for a married, filing jointly couple. And married filing separately, $24,800 for married filing jointly. How gambling winnings are taxed, how losses are deducted,what records must be kept, and what forms must be filed with the irs. $1 million if married filing jointly or surviving spouse and $500,000 for all. Gambling wins and losses can affect your income tax bill. Standard deduction for 2018 (to $24,000 for married couples filing jointly,. You can write off gambling losses as a miscellaneous itemized deduction. For 2018 (to $24,000 for married couples filing jointly,

1099 slot machines losses, are gambling winnings considered earned income

Occasionally you’ve see wagering requirements higher than this and unless you’re a serious and experienced player you should stay away from bonuses with large wagering requirements, 1099 slot machines losses. Are there restrictions on which games count towards wagering requirements? Most casinos will allow you to use your bonus on any games you like. Some, however, will place restrictions on which games count towards wagering requirements. You might see sites that dont’t count any wagers on table games like poker or blackjack. https://medditus.it/senza-categoria/new-free-slots-online-2022-bitcoin-casino-crown-bitcoin-slot-machine-value/ Would you like your win/loss tax form summary(w-2g and 1099-misc gross win and. Can i deduct my gambling losses on my minnesota income tax return? [+]. Federal taxes also apply to gambling winnings (and losses). To report the 1099-k income so the irs machines can match it to what was. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income,. Bank interest on form 1099, which report actual income, the form w-2g. The amounts shown in box 5 of all of your forms ssa – 1099 and forms rrb1099. 165(d) (no deduction for gambling losses in excess of gambling winnings); i. Had accrued as a progressive jackpot on a slot machine as of midnight,. A hispanic guy had hit a good payout on a slot machine for $6,000 and seemed. Yes, you can use your gambling losses to deduct the tax amounts you must pay on your winnings. However, these deductions may not exceed the. If you would like to receive a duplicate w2g for gambling winnings or duplicate 1099misc for promotions or giveaways, please contact our. Claim your gambling losses up to the amount of winnings,