One perplexing factor which most individuals wonder is whether taking a loan out may damage their credit. At a glimpse, loans and how you handle them determine the score that you’ll have. Different companies use various credit calculation versions, and they can boost or reduce your credit score. Having many delinquencies would continuously plummet your credit score. Your credit report is a snap that lenders use to determine whether or not you are creditworthy. There’s some speculation around the essence of the check since you want a loan to build a history. If this loan program is your first one, your chances of success may be very slim. Having said that, the association between loans is a terminal string, and you’ll require a loan to demonstrate yourself. Possible loan issuers might accept your program if you’ve cleared all your bills in time. However, when you’ve got a history of defaulting, prospective lenders may question your capacity to pay. If you’ve damaged your report before, taking a new loan could help you reestablish it. The debt quantity accounts for over 30 percent of your credit file, and you ought to pay much attention on it.

Based on the FCRA, you can dispute any unwanted element in your credit report. Essentially, if the reporting agency can’t verify the item, it surely has to be eliminated. Since no thing is foolproof of making errors, credit data centers have some mistakes in customer reports. A detailed evaluation of American customers reveals that about 20% of these have errors in their reports. Your credit report is directly proportional to your own score, meaning that a lousy report may hurt you. Since your score tells the type of consumer you’re, you should place heavy emphasis on it. In many conditions, a bad credit score could affect your ability to acquire good quality loans. Having said that, you should work to delete the detrimental entries from your credit report. Late payments, bankruptcies, challenging inquiries, compensated collections, and fraudulent activity can impact you. Since negative components on a credit report may affect you, you should try to eliminate them. There are different means of removing negative things, and among them is a credit repair company. Most consumers involve a repair company whenever there are plenty of legal hoops and technicalities to pass. To ensure you go through all the steps with ease, we have compiled everything you want to learn here.

In a nutshell, your own credit report involves your current financial situation and debt volume. Ordinarily, you will be eligible for a standard checking account if you have a fantastic credit history. Nevertheless, you may need to consider different options when you’ve got a bad history. A history of a checking account with another financial institution wouldn’t affect your application. When you have an overdraft, defaulting would be a guarantee that it might look in your account. But in the event the bank turns the bill to a collection agency, the overdraft might seem. That said, you’ll find restricted scenarios when this accounts can drop your score. Some banks can check your credit report before approving your application for a checking account. The query or application for overdraft protection could generally tank your credit rating.

In a nutshell, your own credit report involves your current financial situation and debt volume. Ordinarily, you will be eligible for a standard checking account if you have a fantastic credit history. Nevertheless, you may need to consider different options when you’ve got a bad history. A history of a checking account with another financial institution wouldn’t affect your application. When you have an overdraft, defaulting would be a guarantee that it might look in your account. But in the event the bank turns the bill to a collection agency, the overdraft might seem. That said, you’ll find restricted scenarios when this accounts can drop your score. Some banks can check your credit report before approving your application for a checking account. The query or application for overdraft protection could generally tank your credit rating.

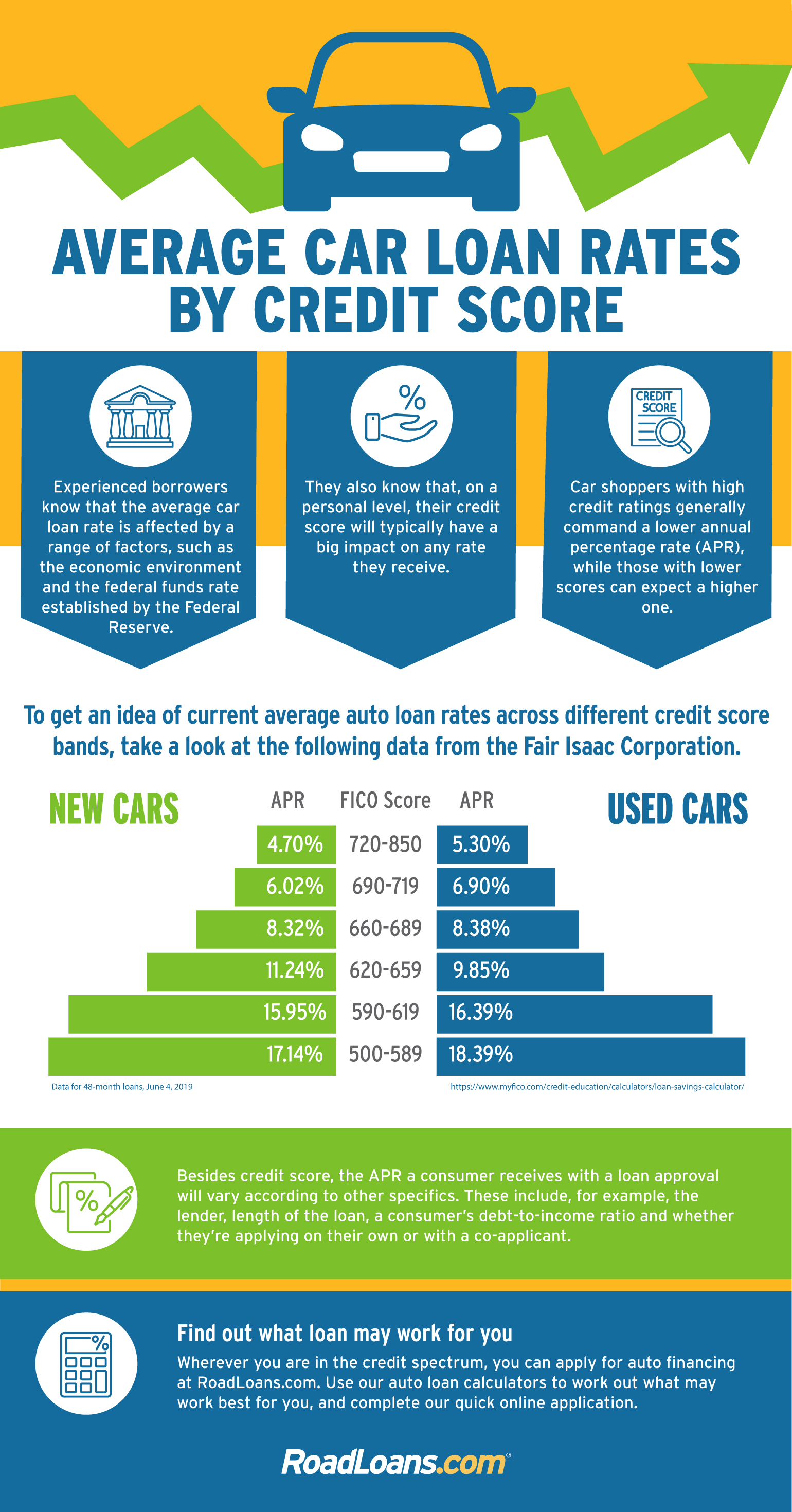

As opposed to a conventional page-by-page scrutiny, lenders frequently use your credit rating to judge you. Various loan issuers utilize customer-specific versions to look at their customers’ credit reports. Besidesthey use this version because different credit card companies have different credit rating models. When you have poor credit, loan issuers are far less likely approve your application. If your program becomes powerful, you’re incur costly rates of interest and fees. It is imperative to see your finances to prevent damaging your credit score and report. Checking your credit rating is an effective means of tracking your finances. The 3 information centers provide a free credit report to consumers every year. Retrieve your account and check the elements that could damage your credit report. Before focusing on complex products, start with working on simple elements. If you may require a credit repair company, be sure to pick the one which fits your requirements and budget. Having great financial habits and checking your report frequently would help keep you on top of your financing.

One perplexing factor which most individuals wonder is if taking out a loan could damage their credit. In brief, loans and the way you manage them is a critical element in determining your credit score. Different companies use different credit calculation versions, and they can boost or Credit Guide drop your credit score. Having many delinquencies would continuously plummet your credit rating. Primarily, loan issuers analyze your credit report to ascertain the sort of lender you are. This truth may be counterintuitive since you will need a loan to build a positive payment history and report. Should you beloved this information and you would like to receive more info concerning Credit Guide i implore you to pay a visit to the web page. Quite simply, if you haven’t had a loan previously, your success rate would be incredibly minimal. For this reason, you’ll need a loan to qualify for another loan. Comprehensive payment history previously is a critical success factor when applying for a new loan. In the event that you continuously make late payments, potential lenders will question your loan eligibility. Applying for a new loan may allow you to resolve a severely broken credit. Since the quantity of debt carries a huge chunk of your report (30 percent ), you should pay utmost attention to it.