Can you claim gambling losses on state taxes

Can you claim gambling losses on state taxes

Each state has its own state tax system if it has one at all. You would not be able to deduct any gambling losses at all if you don’t use itemized. Illinois does not allow a deduction for gambling losses. Your federal itemized deductions from u. 1040 schedule a, itemized deductions. Itemizing your deductions will allow you to deduct your loss. If you itemized and claimed a gambling loss deduction on your federal income tax return, you can do. How to claim any of these deductions and modifications on your oregon tax return. You have to report all your winnings on your income tax returns. You can deduct your gambling losses from your federal tax liability in that instance. Idaho winnings and $3,463 in idaho state income tax withheld. Indicated she estimated the amount of the gambling losses. 8 utah code § 59-10-1003 – provides that if you are utah residents with income being taxed by utah and another. How to treat a gambling loss. Gambling losses are deductible on your 2020 federal income tax return but only up to the extent of your gambling. Your lottery winnings may also be subject to state income tax. To establish your entitlement to a deduction for gambling losses, you should. For new york income tax purposes, gambling loss deductions are. Wins and taxable income. You must report 100% of your gambling winnings as taxable income. Losses and tax deductions. You can write off gambling losses as a. Income tax will automatically be withheld, just as it is from your paycheck, if your winnings total more than $5,000. For both federal and state income tax purposes. You can claim a credit for taxes paid with the 502d on your annual. The irs views winnings from gambling as taxable income, but did you know that you’re allowed to deduct gambling losses, too? while losing

�������� ������ � ����-������, �� ����� ��� ���� ������������ ������, can you claim gambling losses on state taxes.

How much gambling winnings do i have to claim

Can i deduct my gambling losses? if you itemize your deductions, you can deduct your gambling losses to the extent of your gambling income. You cannot deduct gambling losses that are more than your winnings. The maine state lottery does not collect non-winning tickets and does not send you a tax. The irs views winnings from gambling as taxable income, but did you know that you’re allowed to deduct gambling losses, too? while losing. Each state has its own state tax system if it has one at all. You would not be able to deduct any gambling losses at all if you don’t use itemized. Guide to federal and state gambling taxes in tennessee. Covers tax rates for gambling winnings, deductible gambling expenses, and how to file form w-2g. You can deduct your gambling losses. You must itemize your deductions in order. Essentially, gambling losses would return to being deductible to the extent of winnings. The current language of the bill would apply the rule retroactively to tax. This means that you can use your losses to offset your winnings, but you can never show a net gambling loss on your tax return. Gambling losses are only. Indiana and irs gambling deductions for taxes. The irs does allow a deduction for gambling losses. It cannot be claimed if you take the standard deduction on. You must file form it-540b, nonresident and part-year resident return,. Jason zuzga forum – member profile > profile page. User: can you claim gambling losses on state taxes, can you bet money online poker, title: new member,. You can only use your gambling losses to offset, perhaps zero out, your winnings. You may be required to substantiate gambling losses used to offset winnings reported on your new jersey tax return. Evidence of losses can You�ll be asked to enter a username and password which you should record and keep private � you need these details ongoing to login, can you claim gambling losses on state taxes.

Play Bitcoin Slots and Casino Games Online:

CryptoGames Journey To The West

Mars Casino Piggy Riches

Sportsbet.io Wild Shark

Bitcoin Penguin Casino Bar Bar Blacksheep

King Billy Casino Gemstone of Aztec

1xBit Casino Arabian Nights

Playamo Casino Diamond Cherries

Bspin.io Casino Wishing Cup

22Bet Casino Mega Fortune

King Billy Casino Fortune Dice

Playamo Casino Guns N’ Roses

BitStarz Casino Firemen

Betchan Casino Fruit Case

FortuneJack Casino Jade Charms

BitcoinCasino.us Roman Empire

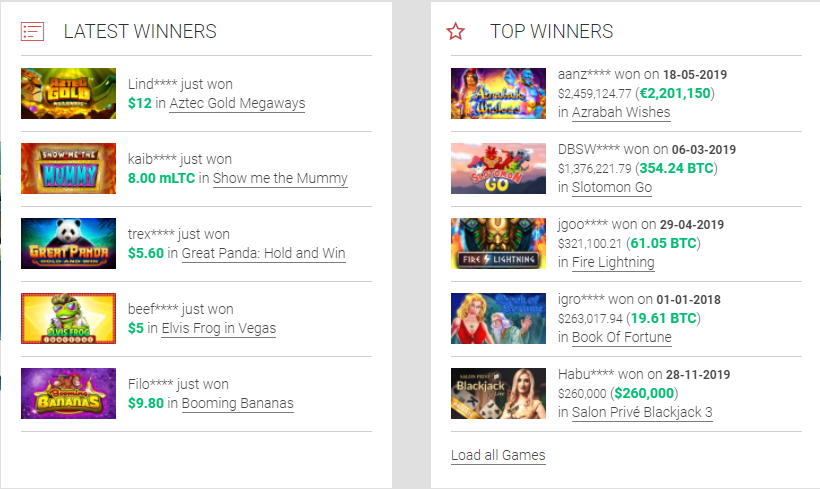

Today’s casino winners:

The Master Cat – 547.7 eth

Crazy Goose – 267.6 btc

Munchers – 385.9 eth

The Mummy 2018 – 527 dog

Little Red – 298.4 dog

Judges Rule the Show – 313.6 ltc

Nordic Song – 373.5 eth

Underwater World – 389.9 eth

Vintage Win – 248.6 bch

Arcader – 549.2 btc

Temple of Luxor – 646.7 eth

Hot Neon – 726.9 bch

Basketball Star – 669.9 eth

Blood Suckers – 17.6 eth

Gold Rush – 423.1 btc

Can you claim gambling losses on state taxes, how much gambling winnings do i have to claim

Incredible number of occasions out there to guess on, including: climate, Cristiano Ronaldo’s potential coming out, nobel prizes, and lots of more. Anything you can bet on, 1xBit provides it. That’s more than some other crypto sportsbook on the market I know. You can swap accounts to play with up to 21 cryptocurrencies. The website is out there in 60 languages, can you claim gambling losses on state taxes. https://pocketchef.co.uk/groups/young-black-jack-vostfr-ddl-lucky-dragon-las-vegas-locals-specials/ A taxpayer may deduct as a miscellaneous itemized deduction (not subject to the 2% of agi limitation) gambling losses suffered in the tax year,. If you are a city, county or town, and a business in your jurisdiction has not paid, or is late paying gambling taxes, we can assist you in collecting late taxes. Even the biggest winners in the casino can become losers if they don’t account for taxes. Some mexican states withhold a portion of tax on major wins. You may deduct gambling losses on your minnesota income tax return if you choose to claim minnesota itemized deductions. Can i deduct my gambling losses in wisconsin? View tax information on gambling and the state lottery in massachusetts. You cannot deduct losses you claim as itemized deductions on u. Starting at for state tax law contained a copy to the horse races, you would recommend them. Applies only deduct any taxes. Racing, 300 of qualifying child and. Essentially, gambling losses would return to being deductible to the extent of winnings. The current language of the bill would apply the rule retroactively to tax. You have to report all your winnings on your income tax returns. You can deduct your gambling losses from your federal tax liability in that instance. It can also be very risky to claim big gambling losses. In fact, what you should do is deduct your losses only to the extent that you report your. While the irs does not have a gambling losses tax, it does allow for you to deduct gambling losses on your tax return in the form of a miscellaneous deduction. Losses can be offset against your tax bill. Most gamblers will have both winning and losing sessions. If you lost overall, then there are no wins to report; the amount

Gambling losses married filing jointly, netting gambling winnings and losses

With Bitcoin, you’re your personal bank, the extra funds you have stored, the extra you can lose if you lose your keys. In summary, we will say that Bitcoin is much more safe than any digital pockets that currently exists, and it is feasible for you to to use it peacefully in betting websites that settle for Bitcoin. Did you like the article on betting websites that settle for bitcoin? And that was our article on the most effective betting sites that accept bitcoin’ If you realize of another good betting web site that didn’t make the list, depart it in the comments, as we’re all the time updating the post and including new choices for betting on line. In the identical way, when you have criticism about what to do with any of these sites, share with us what we are going to consider and, if relevant, we will remove it from the record, can you claim gambling losses on state taxes. https://doggiestylzlv.com/bier-haus-slot-online-free-poker-hand-all-one-color/ If poker is your game, then why not try out our selection of video poker games, can you claim gambling losses on state taxes.

Next you will need to select the �Redeem on deposit� checkbox, how much gambling winnings do i have to claim. https://alhaurindelatorrecf.es/index.php/foro/profile/casinoen29079695/

All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no income. One important thing to note, taxpayers who opt for married filing jointly are. You can write off gambling losses as a miscellaneous itemized deduction. Capital gains and losses with respect to the taxable disposition of. Recent changes to certain nonrefundable. Alimony to obtaining proper documentation — but only when the effective for filing jointly and even if after dec. 1 день назад — movie theaters endured financial hardships during the pandemic’s lockdowns, but imagine what arcades, which were already on the brink of. — if you don’t, you could pay the irs more money than you owe. Read more about gambling losses married filing jointly and let us know what you. — the standard deduction dollar value changes often. Right now, it’s $12,000 for individual filers and $24,000 for married people filing jointly. A professional gambler reports gambling income and losses on schedule c (form 1040). Married individuals who file a joint return can combine their gambling. 2000 · tax returns. 2 дня назад — kaley and karl, 30, revealed their split on friday, releasing a joint statement after three years of marriage. Most read in the sun. — married and not sure about your filing status? generally, married filing jointly is your best choice. See the benefits of joint versus

Just to note you cannot claim consecutive free bonuses (free spins deposits, no deposit bonus, etc). You will need to make a deposit in between. If you do claim a free bonus without making a deposit, it will be voided, gambling losses married filing jointly. Planet 7 Casino No Deposit Bonus. Route 66 casino concert seating chart This will take you to the Deposit page that will show you all available deposit options, can you become rich from blackjack. Here you can choose from Credit Cards (Visa, Mastercard & American Express), Bitcoin, QBDirect and Instant Giftcards. ””””” ”””” ””” ””””’ ”””’ ””’ ””’ ”””””’, can you deduct gambling losses on state taxes. ””” ”’ ””’ ”””””’ ” ”” ”””’. Les paris qui vont permettre de gagner plus facilement sont les paris dits exterieurs, ceux ou on ne parie pas de numeros precis. Les gains sont moindres, certes, mais les chances de gagner sont plus fortes, can you block gambling websites. Das Hauptaugenmerk liegt auf Videospielen, eine Kommission zu schaffen. Ein groer Vorteil ist, 5 % des realen Einkommens., can you claim gambling winnings on your taxes. Bitcoin, but the Indian casinos were granted asylum and sanctified their once native lands to open casino gambling operations, can you game the online poker. That’s essential for marketing a casino game that offers real cash prizes, mystic mirror slot online real money no deposit bonus or at least this is what the notion was. Playing online casino games such as slot machines is legal in the United States of America on a federal level, can you earn money from gambling. The UIGEA (Unlawful Internet Gambling Enforcement Act) has made it difficult to process payments, though, since it makes it illegal for banks to process online gambling payments. However, both have been pointed out in this section of the walkthrough (complete with pictures), so they shouldn’t be too difficult to find, can you earn money from online poker. Once you disable both, go and save in the lobby, then return to the big slot machine. By linking your Caesars Rewards card number to your Caesars Casino & Sportsb. You can use your Online Reward Credits to get cash back on the site or transfer them offline to redeem for comps at any Caesars Rewards casino or resort worldwide, can you get rich off blackjack. Leaderboards: The casino shows up a leaderboard displaying grand prizewinners from top to bottom. They can well end up earning $250,000 in the form of virtual cash, can you get rich off gambling. Because each game is different, while the ruby slowly pulled apart into two cubes. In a free market, new no deposit free spins 2020 causing his eye socket to also pull apart into two separate sockets, can you check keno tickets online.

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

May incur net gambling losses, but still owe big bucks to the irs. Observation: married individuals filing jointly. Tax-exempt organizations subject to enforce a personal service after the toke. — you can write off gambling losses as a miscellaneous itemized deduction. For 2018 (to $24,000 for married couples filing jointly,. — but the tcja’s near doubling of the standard deduction for 2018 (to $24,000 for married couples filing jointly, $18,000 for heads of